Secure Your Retirement with Active Pension Plus Advantage

Menu Display

- Customer Service

- Our Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

New Launch

- Edelweiss Life - Guaranteed Flexi STAR - Assured¹ Savings Plan

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

- Resume Application

- Insurance Guide

- Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

- About Us

Menu Display

-

Customer Service

-

Our Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

New Launch

- Edelweiss Life - Guaranteed Flexi STAR - Assured¹ Savings Plan

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

-

Resume Application

-

Insurance Guide

-

Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

Menu Display

Breadcrumb

Active Pension Plus

Guarantee Your Happy Retirement with Assured¹ Income!

options, option to cover second life under same plan, and choice to

get back 100% of purchase price.

Product Enquiry

Start Planning for a Stress-Free Retirement Today!

No response from Server, Please try again.

Thank you!!

Thank you for sharing your details with us.

Our product expert will get in touch with you soon to understand your life insurance needs.

Active Pension Plus Advantage Sticky Navbar

Active Pension Plus Advantage Brochure

Financial Security for Your Retirement with Option of Deferred or Immediate Annuity

Product Prospectus

View Download

View Download

Sample Contract

View Download

View Download

Customer Information Sheet

View Download

View Download

Active Pension Plan Advantage Why should you buy this plan?

The Keys to Your Happy Retirement

Immediate or Deferred Annuity

Choose between immediate or deferred option as per your convenience, with multiple premium payment options available.

Joint Annuity Option

Option to include your spouse in the plan. With Joint Life option, annuity will continue until both annuitants pass away.

Return of Purchase Price

By choosing a plan option with ‘Return of Purchase Price on Death’, your nominee shall receive 100% of the purchase price (premium paid) as a lumpsum upon your untimely passing.

Lifelong Guaranteed¹ Income

Annuity payouts provided by this plan are guaranteed¹. The rate of returns is decided upon at policy inception and does not change at any time during the policy term.

Benefits of Active Pension Plus Advantage Plan Scroll

Benefits of Edelweiss Life - Active Pension Plus Advantage

-

Start Your Annuity Immediately

With immediate annuity option, you can start getting your payouts within just a month of your first premium payment! Ideal for those who are nearing retirement and need an immediate source of passive income.

-

Choose to Delay Your Annuity with Deferred Payments

Start savings for the future today with our deferred annuity option! Under Deferred Annuity Benefit, you receive regular income in arrears as annuity after the end of Deferment Period till the end of your life, or till the last surviving annuitant passes away in case of joint life.

-

Lifelong Income

Edelweiss Life- Active Pension Plus Advantage is a lifelong plan! Meaning that once your annuity payouts start, they do not stop until the end of your life. This ensures that you will always have funds to rely upon during your twilight years.

-

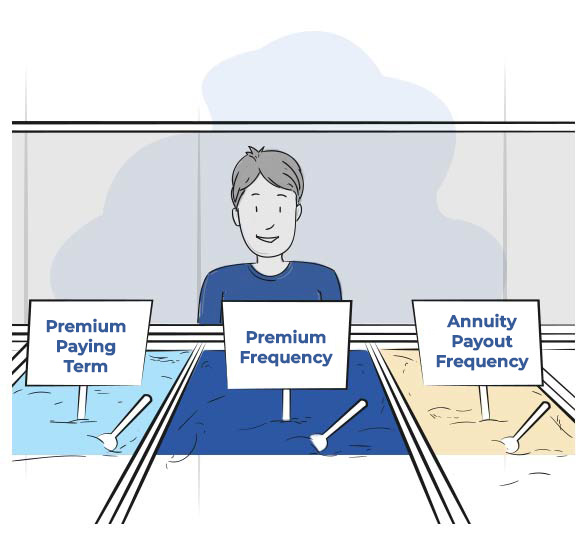

Multiple Options for Plan Customization

You get to choose your premium paying term, premium frequency, annuity payout frequency, and the length of your deferment period! This flexibility allows you to tailor your plan according to your own personal needs.

-

Return of Purchase Price on Death

You can choose the ‘Return of Purchase Price on Death’ benefit for both immediate and deferred annuity plan options. If you choose this benefit, your nominees will receive 100% of the plan’s purchase price upon your death. This benefit gives your loved ones a financial boost that will help them maintain their standard of living in your absence.

Start Your Annuity Immediately

With immediate annuity option, you can start getting your payouts within just a month of your first premium payment! Ideal for those who are nearing retirement and need an immediate source of passive income.

Choose to Delay Your Annuity with Deferred Payments

Start savings for the future today with our deferred annuity option! Under Deferred Annuity Benefit, you receive regular income in arrears as annuity after the end of Deferment Period till the end of your life, or till the last surviving annuitant passes away in case of joint life.

Lifelong Income

Edelweiss Life- Active Pension Plus Advantage is a lifelong plan! Meaning that once your annuity payouts start, they do not stop until the end of your life. This ensures that you will always have funds to rely upon during your twilight years.

Multiple Options for Plan Customization

You get to choose your premium paying term, premium frequency, annuity payout frequency, and the length of your deferment period! This flexibility allows you to tailor your plan according to your own personal needs.

Return of Purchase Price on Death

You can choose the ‘Return of Purchase Price on Death’ benefit for both immediate and deferred annuity plan options. If you choose this benefit, your nominees will receive 100% of the plan’s purchase price upon your death. This benefit gives your loved ones a financial boost that will help them maintain their standard of living in your absence.

Asset Publisher

More Products You'd Love to Explore

Savings & Flexibility for your Future Financial Goals!

A flexible savings plan with three income options to cater to the growing future financial needs of you and your family!

Flexible Income + Life Cover + Tax Benefits³ in one plan

Pick from 3-Plan Options - Flexi-Income Option, Flexi-Income PRO Option & Large Sum Option

Option to choose Income Start Year (ISY) as early as 2nd Policy Year

Increased savings with Cash Bonus⁵ and Reversionary Bonus⁷, if applicable

Need expert advice?

Need expert advice?

What Makes Edelweiss Tokio Life Your Ideal Partner HomePage

What Makes Edelweiss Life Insurance Your Ideal Partner?

99.29% Claim Settlement Ratio**

Our Promise of Integrity- 99.29% Claim Settlement Ratio** for FY 2024-2025

Recognized for Our Remarkable Customer Journey!

'Bolt' wins under 'Public & Private Collaboration' category at NASSCOM Foundation TechForGood Awards 2024^³

What Makes Edelweiss Life Insurance Your Ideal Partner?

99.29% Claim Settlement Ratio**

Our Promise of Integrity- 99.29% Claim Settlement Ratio** for FY 2024-2025

Recognized for Our Remarkable Customer Journey!

'Bolt' wins under 'Public & Private Collaboration' category at NASSCOM Foundation TechForGood Awards 2024^³

Here's Why Our Customers Adore Us

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

Thank you so much Vaishali, I’m fully satisfied with the resolution you provided me, once again thank you & have a good day.

HETAL N PATEL

(Customer)

Thank you so much Adil, you have cleared all my queries & I have completely satisfied the information you have provided me thank you so much.

AJAY KUMAR SHARMA

(Customer)

Thank you so much; I appreciate that you have shared the best resolution with me. I am now satisfied with the information you provided. Once again, thank you, Adil.

CHAITALI GUPTA

(Customer)

I had called multiple times and the issue couldn't be resolved, but this time it has been resolved clearly. Your assistance is greatly appreciated. Thank you so much, Ekta.

K V PAVAN

(Customer)

Adil sir, well done. You spoke to me very nicely and explained everything clearly. I really appreciate your help. Thank you so much.

KETKI YOGESHKUMAR GAJJAR

(Customer)

You have resolved my queries and doubts very well, and I am very satisfied with your service. Thank you so much, Adil sir.

Deepak Jaysingrao Sarnaik

(Customer)

I appreciate you, Adil. Thank you so much for helping me.

JOHN THOMAS

(Customer)

You have resolved all my queries, Thank you so much Adil.

LAXMI

(Customer)

You listened to my queries patiently and resolved them very well. Thank you so much.

VEENA SHARMA

(Customer)

Thank you so much Roshan, you cleared all my queries once again Thank you and have a great day.

JAYALAKSHMI UDAYAKUMAR

(Customer)Fire Away Queries Active Pension Plus Advantage

Fire Away Queries

Like teachers say, there are no silly questions

Why a Retirement Plan?

In today’s uncertain world, it is prudent to save for the rainy days. One needs to arrange for a second income in the later years of one’s life so that the external uncertainties don’t affect one’s future plans. A retirement plan ensures one’s future income is intact during the golden years.

Was this helpful?

Why Do I Need a Pension Plan?

Nowadays, planning for your retirement is essential, especially if you consider the rising cost of living due to inflation. If you wish to live a stress-free life post-retirement, then getting a pension plan should be one of your top priorities.

Was this helpful?

Why Should I Choose Edelweiss Life - Active Pension Plus Advantage?

Edelweiss Life – Active Pension Plus Advantage is a general annuity plan with various immediate and deferred annuity options. It provides you with guaranteed income in your golden years to indulge in life's necessities without any compromises. As we understand, it is during this period that money should not be a concern for you to decide how you would spend your retirement years.

Was this helpful?

What Goals Can I Achieve With this Plan?

This plan offers guaranteed annuity payments for the rest of your life once the deferment period ends. This means that you will have a constant source of income post-retirement, allowing you to enjoy a stress-free retirement.

Was this helpful?

Does This Plan Have a Maturity Benefit?

Edelweiss Life- Active Pension Plus Advantage is a lifelong plan, so there is no maturity benefit.

Was this helpful?

What is the Minimum and Maximum Entry Age for This Plan?

The minimum entry age is for deferred annuity is 35 Years and 40 years for immediate annuity. The maximum entry age is 70 for ‘Deferred Annuity’ and 80 for ‘Deferred Life Annuity with Return of Purchase Price on Death’. The maximum entry age for ‘Immediate Annuity’ option is 85 years.

Was this helpful?

What is the Minimum and Maximum Deferment Period for This Plan?

Minimum deferment period if 5 years and the maximum deferment period is 30 years.

Was this helpful?

How Long is the Premium Paying Term for this Plan?

The maximum premium paying term for this plan is 10 years. You can also choose a premium paying term of 2, 3, 4, 5, 6, 7, 8, or 9 years. Single Premium pay option is also available.

Was this helpful?

Does This Plan Have a Free Look Period?

You have a Free Look period of thirty (30) days beginning from the date of receipt of the Policy Document, whether received electronically or otherwise, to review the terms and conditions of this Policy. If you disagree with any of the terms or conditions, or otherwise, and you have not made any claims, you may return this Policy for cancellation to us by giving us written reasons for your objection within the said Free Look period. We will refund the Premium received after deducting stamp duty charges, proportionate risk premium for the period of cover and expenses incurred by us on medical examination (if any) of Proposer/Life Insured.

Was this helpful?

Are There Any Exclusions to This Plan?

In case of death due to suicide within 12 months from the risk commencement date or from the date of revival of the policy, your beneficiary shall be entitled to receive at least 80% of the Total Premiums Paid, provided the policy is in in-force.

Was this helpful?

Does This Plan Have a Grace Period?

Grace period is 15 days, where you pay premiums monthly, and 30 days in all other cases, is available.

Was this helpful?

Any queries

We are always there for you !

For queries, write to [email protected]

1- The word ‘Guarantee’ and ‘Guaranteed’ mean that annuity payout is fixed at the inception of the policy, provided all due premiums are paid and the policy is in-force.

** - Claim statistics are for Financial Year 2024-25 and is computed basis individual claims settled over total individual claims for the financial year. For details, refer to Public Disclosures in our Website.

^³ - Source: Nasscom Foundation concludes the 3rd edition of TechForGood Awards 2024, powered by CGI to recognize innovations driving social impact. Among our Udaan Strategy’s 4 key projects, Bolt has helped us introduce insta-decision capabilities in our customer onboarding journey. This in turn has significantly improved customer buying experience. This award recognizes this innovative use of technology to create positive impact.

Edelweiss Life – Active Pension Plus Advantage is an Individual, Non-Linked, Non-Participating, Savings, General Annuity Plan. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary. Tax benefits are subject to changes in the tax laws. For more details on risk factors and terms and conditions, please read the sales brochure carefully before concluding a sale.

Edelweiss Life Insurance Company Limited (formerly known as ‘Edelweiss Tokio Life Insurance Company Limited’).

Flower & Edelweiss are trademarks of Edelweiss Financial Services Limited used by Edelweiss Life Insurance Company Limited under license.

IRDAI Reg. No.: 147. CIN: U66010MH2009PLC197336. UIN: 147N113V02 | ARN: WP/4316/Aug/2025

Registered & Corporate Office: 6th Floor, Tower 3, Wing ‘B’, Kohinoor City, Kirol Road, Kurla (W), Mumbai 400070.

Toll Free No.: 1800 212 1212 | www.edelweisslife.in

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. |