Wealth Plus

Menu Display

- Customer Service

- Our Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

New Launch

- Edelweiss Life - Guaranteed Flexi STAR - Assured¹ Savings Plan

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

- Resume Application

- Insurance Guide

- Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

- About Us

Menu Display

-

Customer Service

-

Our Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

New Launch

- Edelweiss Life - Guaranteed Flexi STAR - Assured¹ Savings Plan

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

-

Resume Application

-

Insurance Guide

-

Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

Menu Display

Breadcrumb

Thank you!!

Thank you for sharing your details with us.

Our Investment expert will get in touch with you soon to understand your life insurance needs.

Internal Server Error, Please try again after some time.

Need Assistance?

Wealth Plus

"IN THIS POLICY, INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER"

Opt for Plus-Sized Happiness!

dreams. Presenting, Edelweiss Life Wealth Plus - a plan that

makes additions every year to your premium amount so that you can

reach your goals faster!

Product Enquiry

Take a step ahead to secure your goals

No response from Server, Please try again.

Thank you!!

Thank you for sharing your details with us.

Our product expert will get in touch with you soon to understand your life insurance needs.

Wealth plus Sticky navabar structure

Wealth Plus Brochure

A multiple of single/annualized premium as life cover at all times during policy tenure

Product Prospectus

View Download

View Download

Sample Contract

View Download

View Download

Rate Table

View Download

View Download

Mortality Charges

View Download

View Download

Customer Information Sheet

View Download

View Download

Why Edelweiss Tokio Life Wealth Plus Adds More To Your Life

Why Edelweiss Life Wealth Plus Adds More To Your Life

Let’s Rise Together!

We’ll keep adding to your fund allocation from the first policy year onwards.

Savings Bhi, Protection Bhi

This plan gives you the dual benefit of a life cover and the opportunity to grow your savings.

Look Out for Your Rising Star!

This option gives your child an additional lump sum benefit and waives off future premiums in case you’re no longer around.

Your Move or Mine?

Choose between managing your funds yourself or leaving it to our experts.

Benefits Of Wealth Plus

Benefits Of Wealth Plus

-

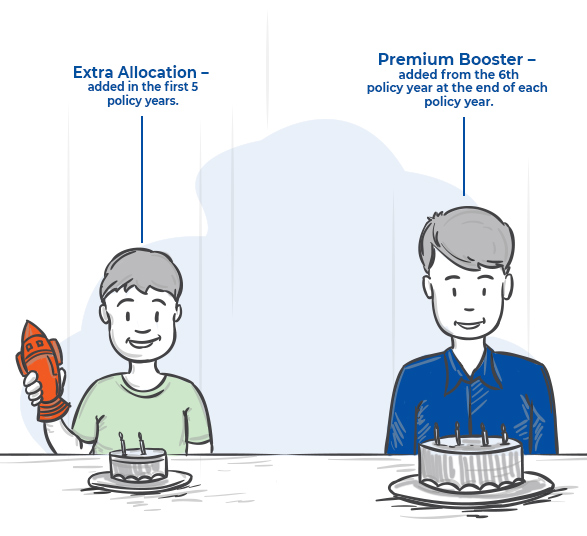

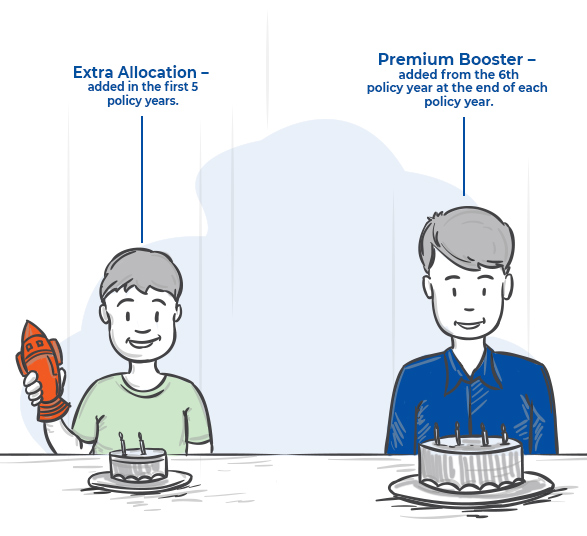

Additional Allocations

We like to treat our friends! This amount starts at 1% of your annual premium for the first 5 years and increases by 2% every 5 years.

-

Rising Star Benefit

Children carry the hope of a brighter future and nothing should diminish their potential. That is why this optional benefit provides an additional payout to your child in case you are no longer around, waives off any future premiums and keeps the policy benefits intact.

-

Investment Strategies

Strategy is the name of the game! You can choose from different types of investment strategies to start growing your wealth. The first is the Self-managed Strategy where you make all the decisions, aided by the power of unlimited switches between funds. The second is the Life Stage and Duration Strategy, where our team of experts manage the funds for you.

-

Easy Liquidity Option

No one likes to wait! You don’t need to wait till the end of your policy term to start getting your returns. From the 6th policy year onwards, you can start making partial withdrawals from your fund value as per your needs

-

Top-Up Premium Option

A little extra goes a long way! Invest any extra funds you have into the policy at your leisure. These extra additions maximize your fund value and get you better returns

-

Tax³ Benefits

No more deductions! The premiums paid under this plan are eligible for tax benefit under Section 80(C) and the returns you get are eligible for tax benefit under Section 10(10D).

-

Additional Allocations

We like to treat our friends! This amount starts at 1% of your annual premium for the first 5 years and increases by 2% every 5 years.

Rising Star Benefit

Children carry the hope of a brighter future and nothing should diminish their potential. That is why this optional benefit provides an additional payout to your child in case you are no longer around, waives off any future premiums and keeps the policy benefits intact.

Investment Strategies

Strategy is the name of the game! You can choose from different types of investment strategies to start growing your wealth. The first is the Self-managed Strategy where you make all the decisions, aided by the power of unlimited switches between funds. The second is the Life Stage and Duration Strategy, where our team of experts manage the funds for you.

Easy Liquidity Option

No one likes to wait! You don’t need to wait till the end of your policy term to start getting your returns. From the 6th policy year onwards, you can start making partial withdrawals from your fund value as per your needs

Top-Up Premium Option

A little extra goes a long way! Invest any extra funds you have into the policy at your leisure. These extra additions maximize your fund value and get you better returns

Tax³ Benefits

No more deductions! The premiums paid under this plan are eligible for tax benefit under Section 80(C) and the returns you get are eligible for tax benefit under Section 10(10D).

4 Steps To Plus-sized Happiness!

4 Steps To Plus-sized Happiness!

Start Your Edelweiss Life Wealth Plus Journey!

- Choose your preferred premium amount

- Choose your policy term

- Choose your premium paying term

Choose Your Fund Strategy

- Choose between the Self-managed strategy or the Life Stage and Duration. The first option gives you the freedom and unlimited switches to make your own choices; the latter gives us the chance to do this for you.

Customize Away!

- Choose your optional benefits (Rising Star)

- Choose the period over which you get your payout (1,2,3,4 or 5 years)

- Choose the frequency of your payout (yearly, half-yearly, quarterly, monthly)

Sit Back and Relax!

- Submit the requested documents

- Let us verify your details and start your wealth accumulation journey!

EdelweissPremiumReturnsCaculatorWeb

Plan Your Financial Growth With Wealth Plus

Bhavesh invested

₹every year for

Year

By the end of 20 years , Bhavesh receives a fund value of

@

Annual Premium Amount: Rs 50,000

Policy Term 20 Years

Fund Value Rs 0

This is a sample Illustration *These assumed rates of returns are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including actual future investment performance. For detailed understanding please refer illustration page.Some benefits are guaranteed, and some benefits are variable with returns based on the future performance of your life insurance company. If your policy offers guaranteed returns, then these will be clearly marked "guaranteed" in the illustration table. If your policy offers variable returns, then the illustrations will show two different rates of assumed investment returns. These assumed rates of return are not guaranteed, and they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance. For detailed understanding, please refer to the product illustration.

Asset Publisher

More Products You'd Love to Explore

Ultimately, it’s All About Fulfilling Your Goals

The plan that systematically helps you grow your wealth and also protects you

Wealth Accumulation + Protection in one plan

Protect your child’s dreams with the Little Champ Benefit Option

Get life cover up to 100 years of age

Choice to invest in 8 diverse funds

Need expert advice

Need expert advice?

What Makes Us Your Ideal Partner

What Makes Us Your Ideal Partner

99.29% Claim Settlement Ratio**

Our Promise of Integrity- 99.29% Claim Settlement Ratio** for FY 24-25

Recognized for Our Remarkable Customer Journey!

'Bolt' wins under 'Public & Private Collaboration' category at NASSCOM Foundation TechForGood Awards 2024^³

What Makes Us Your Ideal Partner

99.29% Claim Settlement Ratio**

Our Promise of Integrity- 99.29% Claim Settlement Ratio** for FY 24-25

Recognized for Our Remarkable Customer Journey!

'Bolt' wins under 'Public & Private Collaboration' category at NASSCOM Foundation TechForGood Awards 2024^³

Here's Why Our Customers Adore Us

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

Thank you so much Vaishali, I’m fully satisfied with the resolution you provided me, once again thank you & have a good day.

HETAL N PATEL

(Customer)

Thank you so much Adil, you have cleared all my queries & I have completely satisfied the information you have provided me thank you so much.

AJAY KUMAR SHARMA

(Customer)

Thank you so much; I appreciate that you have shared the best resolution with me. I am now satisfied with the information you provided. Once again, thank you, Adil.

CHAITALI GUPTA

(Customer)

I had called multiple times and the issue couldn't be resolved, but this time it has been resolved clearly. Your assistance is greatly appreciated. Thank you so much, Ekta.

K V PAVAN

(Customer)Fire Away Queries

Fire Away Queries

Like teachers say, there are no silly questions

What is a wealth accumulation / savings plan?

As an achiever, you would want to make the most of your achievements by enjoying a good lifestyle or planning for some big moments in your life. You may want an early retirement which can be enjoyed in grand style or it could be international education for your child. However, it is also important that we take necessary steps to take care of our family in all certain and uncertain events. Thus, it would be ideal to invest in a plan which takes care of financial security of your family and also helps you accumulate wealth.

Was this helpful?

Why should I opt for Edelweiss Life – Wealth Plus?

Edelweiss Life – Wealth Plus offers to increase your fund value at the end of each policy year. You have the option to especially cater to your child’s future financial needs when you’re not around.

Was this helpful?

What kind of goals will this plan help me achieve?

As this plan aids you in wealth accumulation while giving protection to your family and tax*¹ benefits, it gives you the freedom to pursue a number of goals. Some of the goals you can achieve include an early retirement which can be enjoyed in grand style or even an international education course for your child.

Was this helpful?

Does this plan cover death due to COVID-19?

Yes, this plan covers death due to COVID-19.

Was this helpful?

What are the premium paying frequencies available?

You can choose to pay your premiums on an annual, half-yearly, quarterly or monthly basis.

Was this helpful?

What is the minimum and maximum policy term?

The minimum policy term is 10 years and the maximum policy term is 20 years.

Was this helpful?

What is the minimum and maximum entry age?

The minimum entry age is 1 year and the maximum entry age is 55 years.

Was this helpful?

What is the minimum and maximum maturity age?

The minimum maturity age is 18 years and the maximum maturity age is 70 years.

Was this helpful?

What is the minimum and maximum top-up premium?

The minimum amount you can invest as top-up premiums is Rs. 5,000. The maximum amount cannot exceed the amount generated by combining all the base premiums paid till that date.

Was this helpful?

What are Extra Allocations?

Extra Allocation is one of the additions we make to your plan. This benefit begins from your first policy year. From 1st to 5th policy year, 1% of the annualised premium is added to your fund value.

Was this helpful?

What is Premium Booster?

Premium Booster is another benefit we offer to help you maximize your returns. Starting from the 6th policy year, they are added to your fund(s) at the end of each policy year. For instance, the Premium Booster from 6th to 10th policy year is 3% of the annualized premium, 11th to 15th policy year is 5% of the annualized premium, from 16th to 20th policy year is 7% of the annualized premium, and so on and so forth.

Was this helpful?

What is Rising Star Benefit?

This optional benefit is designed to safeguard your child’s future in case of unfortunate circumstances. If the Rising Star Benefit has been chosen, an additional benefit will be applicable on your life in addition to the death benefit. On your demise, this additional benefit is applicable for the entire policy term irrespective of your child’s age.

Was this helpful?

What will the child get from Rising Star Benefit?

On your demise, your child will receive the following benefits:

- A Lump Sum amount will be paid immediately

- An amount equal to the sum of all the future Modal Premiums (if any) shall be added to your Fund Value

- The future Extra Allocation and Premium Booster as and when due would be added to the Fund Value.

- The Policy will continue till maturity date or death of your child, whichever is earlier

- Life Cover of your child will continue.

- The Lumpsum Amount will be equal to Annualised Premium x applicable Annualised Premium multiple as mentioned below. This Annualised Premium multiple will depend on the entry age of the Policyholder.

Was this helpful?

Are there unlimited free switches between funds?

If you have chosen Self-Managed Strategy, you can move money between the funds depending on your financial priorities and investment outlook. This facility is called switching and is available free of cost. Minimum amount per switch is Rs. 5,000. In case your current Investment Strategy is Life Stage & Duration Based Strategy, switching facility is not available.

Was this helpful?

How many opt-in and opt-out options are there between the Investment Strategies?

There are unlimited opt-in and opt-out options during the policy term.

Was this helpful?

What is Premium Redirection?

You can choose to allocate future premiums including top-up premiums in fund(s) different from those selected at policy inception or previous premium redirection request. This facility is called premium redirection, which is unlimited and free of cost. This option is available only with self -managed strategy.

Was this helpful?

What are Partial Withdrawals and how are they beneficial?

Partial Withdrawal is a benefit offered with this plan. It allows you to withdraw a part of the Fund Value as per liquidity requirements at any time after the completion of the fifth policy anniversary. These are subject to terms & conditions.

Was this helpful?

What are Top-up Premiums?

It is a benefit offered to invest surplus money as a premium over and above the existing premium amount.

Was this helpful?

What is Surrender benefit?

At any time during the policy term, you can choose to surrender the policy by submitting a written request to us.

Was this helpful?

Is there any exclusion to this plan?

In case of your death due to suicide within 12 months from the Policy Commencement Date or from the date of Revival of the Policy, the nominee or beneficiary shall be entitled to the Fund Value as available.

Was this helpful?

What is the free look period of this policy?

You have a freelook period of 30 days from the date of the receipt of the policy document for the policy issued after 1st April, 2024 and processing TAT for same is 7 days.

Was this helpful?

Do I get any Grace period to pay my premium?

Do I get any Grace period to pay my premium?

Grace Period of 30 days is available for annual, semi-annual and quarterly premium payment frequency and 15 days for monthly premium payment frequency.

Was this helpful?

Any Queries For Wealth Plus

We are always there for you!

For queries, write to [email protected]

Contact us on 022 6611 6029

Wealth Plus Videos Slider

Videos

^³ - Source: Nasscom Foundation concludes the 3rd edition of TechForGood Awards 2024, powered by CGI to recognize innovations driving social impact[SI1] . Among our Udaan Strategy’s 4 key projects, Bolt has helped us introduce insta-decision capabilities in our customer onboarding journey. This in turn has significantly improved customer buying experience. This award recognizes this innovative use of technology to create positive impact.

** - Claim statistics are for Financial Year 2024-25 and is computed basis individual claims settled over total individual claims for the financial year. For details, refer to Public Disclosures in our Website.

3- As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year.

IN UNIT LINKED INSURANCE PLAN (ULIP), INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER. Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. Edelweiss Life Insurance is only the name of the Insurance Company and Edelweiss Life – Wealth Plus is only the name of A Unit Linked, Non-Participating, Individual, Life Insurance Product and does not in any way indicate the quality of the contract, its future prospects, or returns. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary or policy document of the Insurer. The premium paid in unit linked life insurance policies are subject to investment risk associated with capital markets and the unit price of the units may go up or down based on the performance of investment fund and factors influencing the capital market and the policyholder is responsible for his/her decisions. Tax benefits are subject to changes in the tax laws. For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

Edelweiss Life Insurance Company Limited (formerly known as ‘Edelweiss Tokio Life Insurance Company Limited’).

Flower & Edelweiss are trademarks of Edelweiss Financial Services Limited used by Edelweiss Life Insurance Company Limited under license.

IRDAI Reg. No.: 147 | CIN: U66010MH2009PLC197336 | UIN: 147L055V04 | ARN: WP/4300/Jul/2025

Registered & Corporate Office: 6th Floor, Tower 3, Wing ‘B’, Kohinoor City, Kirol Road, Kurla (W), Mumbai 400070.

Toll Free No.: 1800 212 1212 | www.edelweisslife.in

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. |