Premium Payment Terms | Types | Benefits

Blog Title

38439 |

6/16/25 8:53 AM |

Life insurance plans are essential if you want to financially secure your loved ones in your absence. In its most basic form, a life insurance plan will provide you with a life cover amount in exchange for premiums. This life cover amount will be paid out to your dependents in case of your untimely death during the policy term. You generally have to pay your premiums regularly to keep your policy active. However, some life insurance plans allow you to pay off your premiums well before the completion of your policy term!

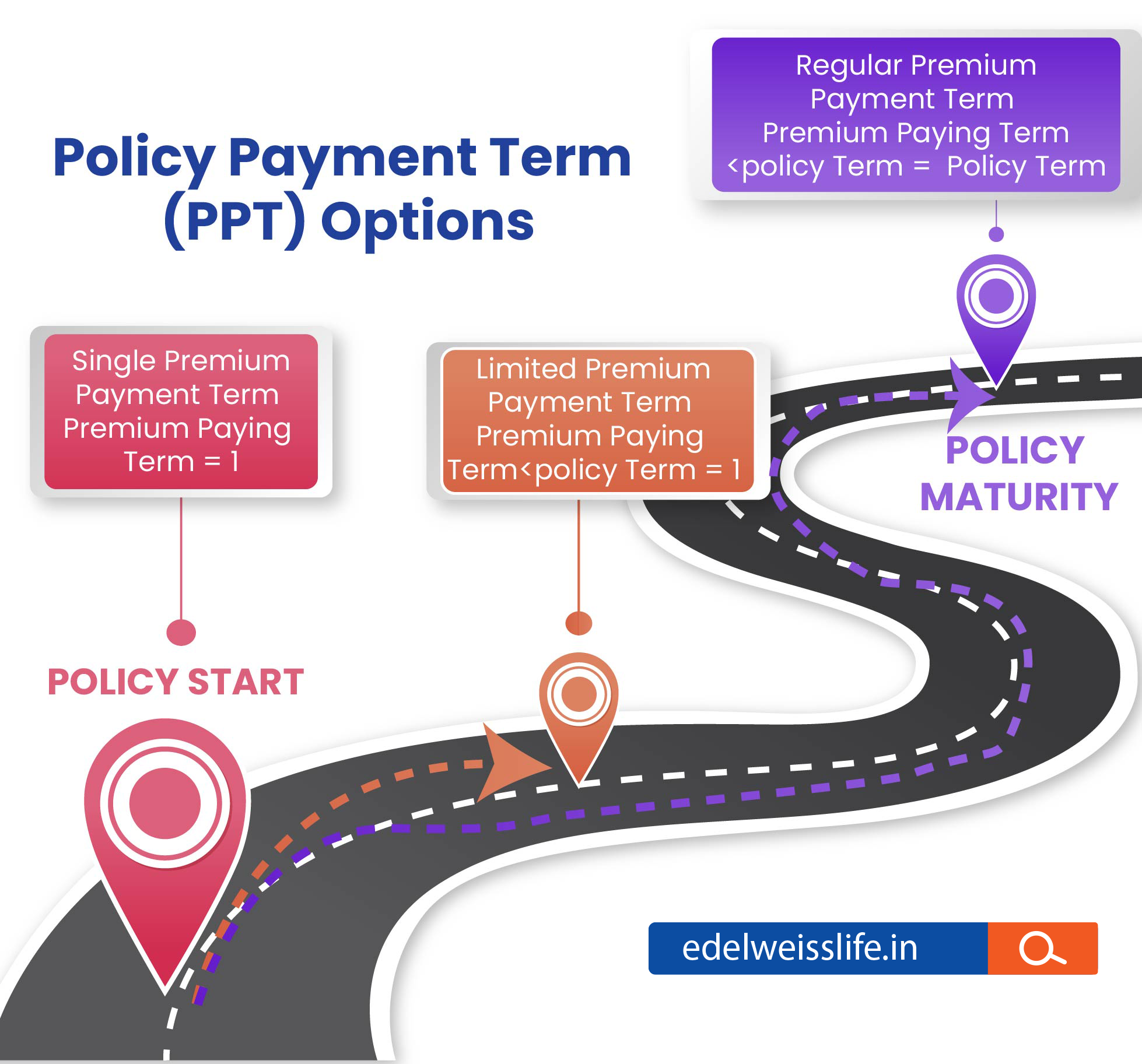

This is where the concept of the ‘premium paying term’ comes into play. Most people think that the ‘premium paying term’ is the same as the ‘policy term’. But this thought is not completely accurate. The policy term is the total period of time within which your life cover element is valid, i.e., it is the ‘lifespan’/validity period of your life insurance policy. On the other hand, premium paying term merely refers to the period during which you need to make regular premium payments.

Meaning of Premium Paying Term (PPT)

The Premium Paying Term or PPT is the period for which you must pay the required premiums for your life insurance policy. In other words, it is the term for payment of premiums. Generally, in case of Term Insurance, the premium payment term is usually equal to the policy term. When the PPT is equal to the policy term, such a policy is called a ‘regular pay’ plan.

However, some insurance policies like Guaranteed Income Plans or ULIPs, allow the policyholder to select a premium-paying term that is shorter than the policy term. These policies may also offer you the flexibility of choosing your premium payment term; for example, 5, 8, 10 & 12 years etc. So, if you choose a policy term of 10 years but a PPT of 5 years, you will pay off your due premiums within the first 5 years itself and you will not have to pay any additional premiums for the rest of your term.

Some insurers even allow you to get insurance benefits if you cease to pay premiums during the premium paying term by turning the standard insurance policy into a paid-up policy.

Premium Paying Term vs Policy Term

Premium Paying Term and Policy Term are two different things that are often confused as one.

Premium Paying Term |

Policy Term |

The time period within which you pay your premiums. |

The total time period of your life insurance policy. |

Your policy will lapse if you fail to pay premiums during this term. |

If you have finished paying off your premiums, then your policy cannot lapse. Life cover will continue until the very end of your policy term. However, you may choose to surrender the policy at any time during the policy term. |

Is always shorter than the policy term, unless you opt for regular pay, in which case it will be equal to the policy term. |

Can never be shorter than the premium paying term, signifies the total duration of your life insurance policy. |

Why is Premium Payment Term Important?

Deciding the right premium payment term for your policy is extremely important for budgeting your finances. Do you have enough income to pay off the entire premium in just a few years? Or would large payments be too hectic for your budget? Do you want to pay off your premiums as quickly as possible or do you not mind regularly paying a small amount every single month? Answering all these questions will help you select a plan with the right premium payment term for you.

Types of Premium Payment Terms

There are pros and cons to each type of premium payment term, and you need to determine what term is best suitable for your budget. The various types of premium payment terms are listed below:

Regular Premium Payment Term: If the premium payment term is the same as or equal to the policy term, you must pay premiums for the whole policy term. This is referred to as regular premium payment. For example, if the policy period is 20 years, you must pay premiums for 20 years.

Limited Premium Payment Term: The other possibility is that the premium paying term is shorter than the policy term. In such cases, you pay premiums for a limited time, but the life insurance coverage continues until the policy term expires. For example, you may select a policy duration of 20 years but pay premiums only for the first ten years.

Single Premium Payment Term: The entire premium amount is paid as a lump sum in one instalment for the policy coverage till the end of the policy. For example, you may select a policy duration of 60 years but pay premium once as a single premium.

Flexible Premium Payment Term: Flexible premium payment term basically means that you can adjust your premium payment amount and frequency (to a certain limit specified by the insurer) according to your needs. Flexible premium pay allows you to pay premiums safely even during financially difficult times. Flexible premium payment option is an enhancement of the limited pay model.

How to Choose the Right Payment Term?

The right payment term for you will depend on how quickly you want to pay off your premium, and how much money you are willing to spend on insurance in the short term.

Benefit of Single Pay

If you don’t want the burden of paying premiums periodically, then just opt for the single pay model. With single pay, you just have to pay a lumpsum amount at the beginning of the policy to enjoy the benefits for the rest of the term. However, keep in mind that single pay premium policies generally do not offer the same benefits and coverage as limited or regular pay policies.

Benefit of Regular Pay

Regular pay is best if you do not mind paying premiums until the very end of your policy term. The periodic premium payments for Regular pay are generally more affordable than limited pay, making it the better model of payment if you are on a tight budget.

Benefits of Limited Pay

If you do not want to pay premiums for the entirety of your term but still want all the benefits of a regular pay policy, then the limited pay model is ideal for you. With limited pay, you can pay off your premiums as quickly as possible. Once your premium has been paid off, you can enjoy the policy’s life cover and other benefits without having to pay a single additional dime.

Moreover, the total premium amount payable in limited pay is generally smaller when compared to regular pay, though this might not always be the case. The main downside of limited pay model is that your periodic premium payments will be much more expensive, as you are paying off the entire premium amount in a much short timeframe.

Premium Payment Modes

In regular and limited payment term options, premium payments can be made monthly, quarterly, bi-annually, or annually.

Monthly- You pay a small premium charge each month of the year.

Quarterly- You pay a part of your annual premium every 3 months of the year (quarter).

Bi-Annually- You pay premiums every six months (half-yearly).

Annually- You pay one single lumpsum premium amount every year.

Conclusion

Choosing your premium paying term is one of the most important steps of buying a life insurance plan. You need to make regular premium payments to ensure your policy’s validity, and hence you need to choose a PPT that you are comfortable with in the long term. Consider your financial stability, annual income, and various expenses before committing to a premium paying term. Ensure that the PPT you choose is ideal for your personal financial budget so that you can maintain your family’s financial security for year to come.

FAQs

Can I change my premium paying mode after I purchase a policy?

This depends on your insurance provider’s terms and conditions. Some insurers may allow you to change your PPT while other do not allow you to change the term once the policy has been purchased.

What happens if I miss a premium payment?

If you miss a premium payment, your policy is not immediately terminated. Instead, your policy will enter a ‘grace period’. This grace period lasts for 15 days, when you pay premiums monthly, or 30 days in all other cases. You can keep your policy active if you pay your due premiums during this grace period. Your policy will only lapse if you fail to complete your payments during this grace period.

What are the penalties for late payment of term insurance premiums in India?

If you pay your premiums within the grace period, then there are no penalties for late payment. However, if you miss the grace period as well, then your policy will lapse. A lapsed policy will no longer provide the same benefits as a fully active policy. If your policy has a paid-up benefit clause, then it will still provide a reduced life cover amount. However, if your policy does not have a paid up clause, then all your benefits will terminate, and your family will no longer be protected with the plan’s life cover element.

Can I pay my premiums in advance for multiple years?

Yes, some plans allow you to pay your premiums in advance.

Is it possible to resume a lapsed policy by paying overdue premiums?

Yes, some insurance companies do allow you to reactivate a lapsed policy if you pay back your overdue premiums (with added interest). However, some insurers may also require you to undergo a new medical test. Your premium rates may also be altered upon renewal of your policy.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.