Do Term Plans Have Maturity Benefits in India?

Blog Title

2736 |

12/18/24 7:30 PM |

More and more people are realizing the importance of securing their loved ones with term insurance. According to a study by Policybazaar, term insurance purchases among self-employed individuals has increased by 50% over the past financial year. There is an increasing demand for term insurance as people are taking financial planning more seriously and are striving to protect their loved ones even in their absence.

Term insurance plans are also known as “pure risk cover” plans, meaning that their main goal is to simply provide life cover in exchange for premiums. This also means that term insurance plans have no investment or savings element whatsoever. In a term plan, all premiums go towards providing you with life cover and no maturity benefit is payable at the end of the policy. The upside of this is that premium rates for term plans tend to be far more affordable. But the downside is that all the money invested in a term plan offer no returns if you survive till the end of your policy term.

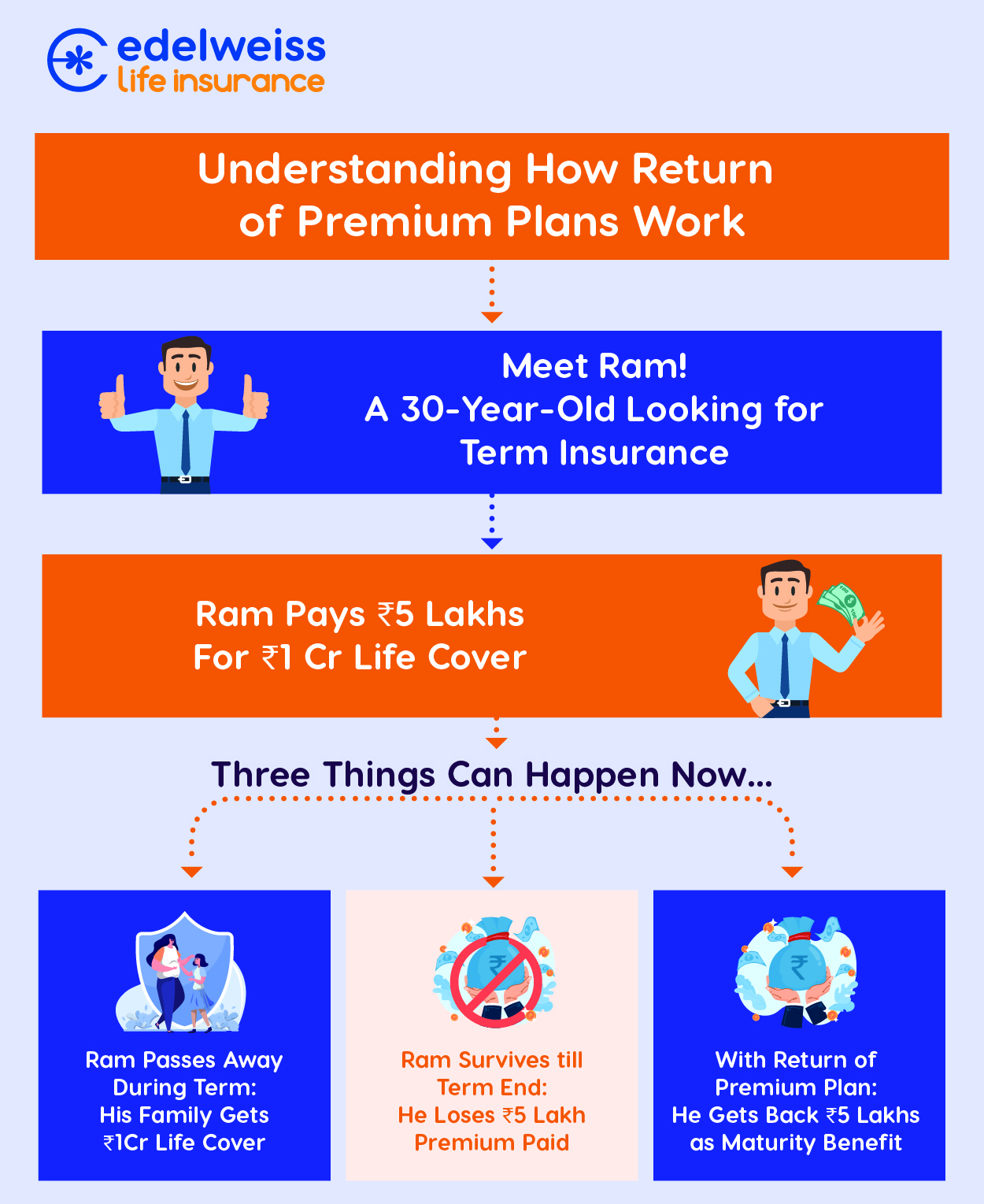

However, there is one exception to this rule- Term insurance plans with “Return of Premium”. As the name implies, return of premium plans pay back all your premiums if you survive until the very end of the policy term. Usually, your premium amount is paid back in the form of a maturity benefit in one single lumpsum payout.

Understanding How Return of Premium Plans Work

Why Choose a Return of Premium Plan?

Term plans generally do not have any maturity benefits, so people who expect some sort of return on their investment will prefer a return of premium policy. Additionally, getting back your premium amount as a lumpsum at the end of the policy term can help you plan for a major financial goal. Of course, return of premium plans still provide life cover to your loved ones during the policy term. So, you end up benefitting both during and after your policy term!

Types of Maturity Benefit Payouts in Term Plans

Maturity benefit can be paid out in two ways:

Lumpsum Payout: One single payout where you get back the total sum of your paid premiums. This sum will exclude any amount paid as GST or for medical expenses. Premiums paid towards riders may or may not be included depending on the terms and conditions of your specific policy.

Regular Income Payout: Instead of getting all your returns in the form of a single payment, under this option you will receive small instalments at regular intervals. These instalments will continue until the total premium amount you invested is paid back.

Are There Any Tax benefits for Returns in a Term Plans?

Yes, return of premium term plans are also subject to tax benefits under the Income Tax Act of 1961. Section 10(10D) ensures that your plan’s death benefit is completely tax free. Your maturity benefits may also be tax free if your policy meets the section’s terms and conditions. And all premiums you pay towards your return of premium plan are subject to tax deductions under Section 80C of the Income Tax Act. Keep in mind that these tax benefits are currently applicable only under the Old Tax Regime of India.

Conclusion

Term insurance plans ensure that your family remains protected even in your absence. However, these plans have no savings element whatsoever and do not provide any sort of financial growth. But you can opt for a return of premium plan to get back your money in the form of a refund. Money back plans essentially reduce your premium cost to zero if you survive till the end of the term. And the money that is returned to you can be used to assist you with any financial plans you may have in the future.

Edelweiss Life- Zindagi Protect Plus is a flexible term plan that offers both basic term insurance as well as a return of premium option. The basic life cover option does not offer any money back at the end of the term, but the upside is that you pay lower premiums and get access to several optional benefits. On the other hand, the return of premium option ensures that you get back all your premiums at the end of the term, ensuring that you have some financial padding for the next stage of your Zindagi!