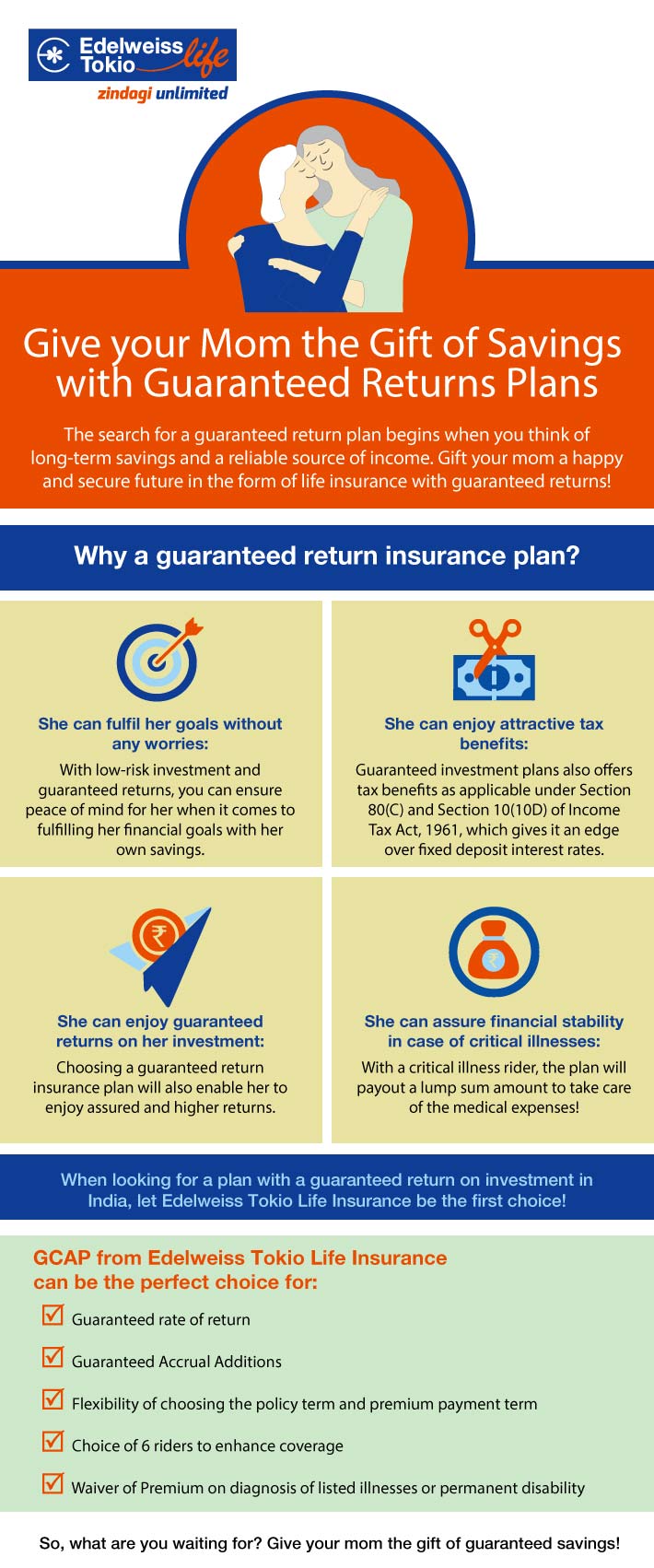

Give your Mom the Gift of Savings with Guaranteed Returns Plans

Blog Title

2552 |

7/31/23 8:23 AM |

The search for a guaranteed return plan begins when you think of long-term savings and a reliable source of income. Here is a quick look why guaranteed returns plans are the best gifts for your 'pyaari maa’!

Why a guaranteed return insurance plan?

With low-risk investment and guaranteed returns, you can ensure peace of mind for her when it comes to fulfilling her financial goals with her own savings. [PP1] [PP2] [Bh3]

- She can enjoy guaranteed returns on her investment:

Choosing a guaranteed return insurance plan will also enable her to enjoy assured and higher returns.

- She can enjoy attractive tax benefits:

Guaranteed investment plans also offers tax benefits as applicable under Section 80(C) and Section 10(10D) of Income Tax Act, 1961, which gives it an edge over fixed deposit interest rates.

- She can assure financial stability in case of critical illnesses:

With a critical illness rider, the plan will payout a lump sum amount to take care of the medical expenses!

When looking for a plan with a guaranteed return on investment in India, let Edelweiss Life Insurance be the first choice!

GCAP from Edelweiss Life - GCAP Insurance can be the perfect choice for:

- Guaranteed rate of return

- Guaranteed Accrual Additions

- Flexibility of choosing the policy term and premium payment term

- Choice of 6 riders to enhance coverage

- Waiver of Premium on diagnosis of listed illnesses or permanent disability

So, what are you waiting for? Give your mom the gift of guaranteed savings!

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.