Asset Allocation

Blog Title

5766 |

4/11/23 7:01 AM |

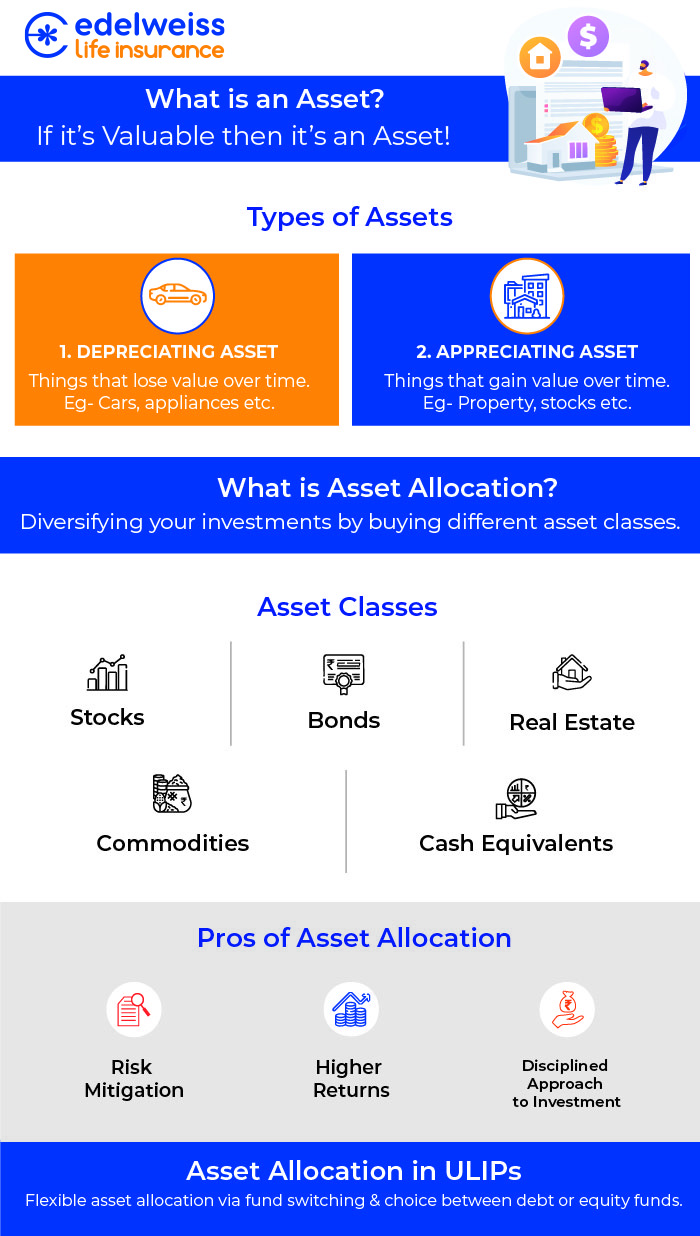

To understand asset allocation, we first need to define what an asset is.

What is an Asset and its Different Types?

Asset is anything that you own and has a value. For ex, land, car, mobile, brand etc. This asset can be both tangible and intangible.

- Tangible assets are physical assets that can be touched, felt, or seen with human eyes. For example, office furniture, land, building, goods which are in process etc. On the other hand, intangible assets are assets that have no physical value. For example, goodwill of a brand, patents, software etc.

- Another thing to keep in mind about an asset is that they can be, appreciating and depreciating, meaning, it does not necessarily have positive impact on your money. Appreciating assets are the ones which increase in value over time. Depreciating assets are those that decline in economic value over time and with use. Examples of commonly depreciating assets include cars, furniture, equipment (such as computers and electronics), machinery, and sports gear. For example, land is generally an appreciating asset which car is a depreciating asset.

What Are Financial Assets?

Financial assets do not always have an intrinsic physical value or even a physical form, unlike real estate, or commodities. Instead, the market conditions in which they trade and the level of risk they involve are what determine their worth. For example, Bonds, derivatives, fixed deposits, equity shares, and insurance contracts are a few types of financial assets.

Term insurance policies (which have no cash value) are also valuable—they provide essential life insurance protection. However, since term policies do not include a cash value you can access, they are not technically considered an asset.

What Is Asset Allocation?

Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The goal is to balance risk and reward by considering an individual's investment goals, risk tolerance, and investment time horizon. By spreading investments across different asset classes, investors aim to reduce the impact of market volatility on their portfolio. By diversifying their portfolio, investors can potentially lower the risk of loss and increase the chances of earning better returns.

What is Asset Allocation in ULIPs?

Asset allocation in Unit Linked Insurance Plans (ULIPs) can provide several benefits, including:

- Diversification: By investing in a mix of asset classes such as equity, debt, and balanced funds, asset allocation helps diversify your portfolio. This diversification can help spread risk and potentially reduce losses.

- Customization: With ULIPs, you can customize your asset allocation based on your risk tolerance, financial goals, and investment horizon. This flexibility can help you tailor your portfolio to your specific needs.

- Potential for higher returns: By investing in a mix of asset classes, you can potentially earn higher returns than by investing in just one asset class. The equity component of the portfolio can provide higher returns, while the debt component can offer stability and income.

- Risk management: Asset allocation can help manage risk by reducing exposure to a single asset class. For instance, if equities are performing poorly, the debt component can provide stability and reduce losses.

- Long-term wealth creation: ULIPs are long-term investment products, and asset allocation can help create long-term wealth by providing exposure to different asset classes that perform differently over time.

Overall, asset allocation can provide a disciplined and systematic approach to investing in ULIPs, helping you achieve your financial goals while managing risk.

What Is the Importance of Asset Allocation?

Asset allocation is an essential strategy for managing investment risk. By dividing investments across different asset classes, it allows investors to spread their risk and minimize the impact of market fluctuations on their portfolio.

Meaning, if one asset underperforms, other assets in the portfolio can potentially compensate for the loss, helping to balance the overall risk and return of the portfolio. Additionally, asset allocation can help investors to achieve their investment goals and align their portfolio with their risk tolerance and time horizon. It is a key aspect of a well-structured investment plan.

What are the Benefits of Asset Allocation?

- Gains on Investment Made - A well-planned asset allocation strategy can help you to determine the potential returns on your investments. With the right skills, you can make informed decisions about how to allocate your funds to achieve financial objectives. If you fail to properly allocate your funds and often invest without a plan, it will make it challenging to determine if the returns on your investment are sufficient to meet your financial goals.

- Spreading The Risk Factor – You can develop your investment plan and portfolio allocation based on your past experiences and risk tolerance. For example, if you have had positive returns from previous equity investments, you may be more willing to take on higher risk by investing in equity-oriented funds. Conversely, if an investor has not seen satisfactory results from previous investments, they may choose to invest in lower-risk options such as fixed deposits or recurring deposits. Using past investment experiences as a guide can help investors to make sound asset allocation decisions and achieve their financial goals more easily. Through asset allocation, investors can reduce investment risk and increase their confidence in achieving their desired outcomes.

- Fund Switching with Market-Linked Returns - Asset allocation is an ongoing process, not a one-time action. Many ULIPs now offer policyholders the ability to reallocate funds a certain number of times per policy year. This feature allows you to align your investments with market conditions. For instance, if the market is trending positively, you may want to increase your allocation to equity funds. Conversely, if the market is trending negatively, you may shift your funds to debt funds.

In summary, after understanding the benefits of fund allocation in ULIPs, this type of investment plan offers several advantages. However, it is important to conduct thorough research before making any decisions about portfolio allocation. - Tax Benefits on Investment - ULIP investments qualify for tax deductions under Section 80C of the Income Tax Act, and the returns on the policy have tax-advantages upon maturity as per Section 10(10D) of the Income Tax Act. Therefore, investing in an asset allocator fund through a ULIP can provide tax benefits for the investor.

Many young investors are concerned about making the wrong investment choices. By identifying your risk tolerance and financial objectives, you can select an asset allocation strategy that suits them best. This can help you to make more informed investment decisions and reduce the risk of making costly mistakes.

Too much information in the first paragraph. Please simplify this and break into paragraphs.

For example, one para can be about tangible and intangible, explaining meaning of these terms with examples.

The next paragraph can talk about appreciating and depreciating. Again, along with meaning and example.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.