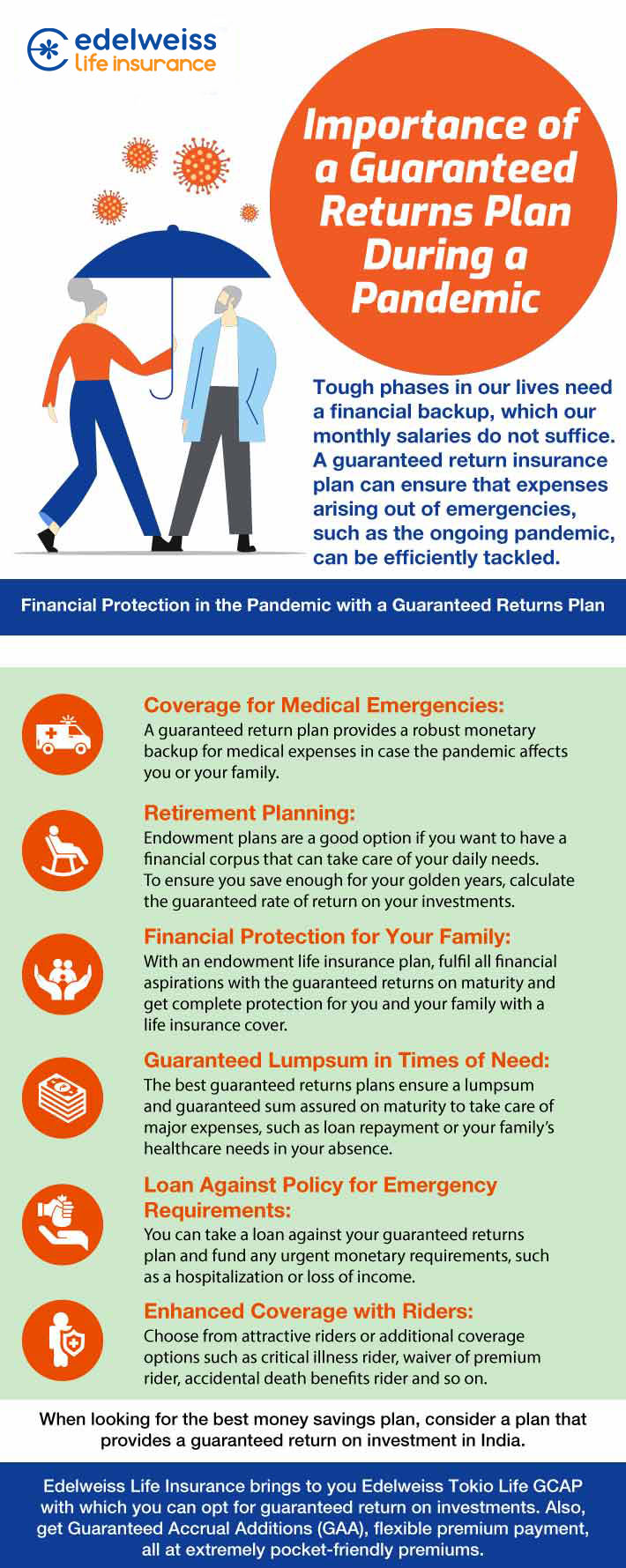

Importance of a Guaranteed Returns Plan During a Pandemic

Blog Title

2197 |

8/7/23 11:34 AM |

Table Of Contents

Tough phases in our lives need a financial backup, which our monthly salaries do not suffice. A life insurance savings plan can be of great help here.

When looking for the best money savings plan during a pandemic, consider a plan that provides a guaranteed return on investment in India.

Financial Protection in the Pandemic with a Guaranteed Returns Plan

- Coverage for Medical Emergencies: A guaranteed return plan provides a robust monetary backup for medical expenses in case the pandemic affects you or your family.

- Retirement Planning: Endowment plans are a good option if you want to have a financial corpus that can take care of your daily needs. To ensure you save enough for your golden years, calculate the guaranteed rate of return on your investments.

- Financial Protection for Your Family: With an endowment life insurance plan, fulfil all financial aspirations with the guaranteed returns on maturity and get complete protection for you and your family with a life insurance cover.

- Guaranteed Lumpsum in Times of Need: The best guaranteed returns plans ensure a lumpsum and guaranteed sum assured on maturity to take care of major expenses, such as loan repayment or your family’s healthcare needs in your absence.

- Loan Against Policy for Emergency Requirements: You can take a loan against your guaranteed returns plan and fund any urgent monetary requirements, such as a hospitalization or loss of income.

Neha Panchal - Financial Content Writer

Neha used to be an Engineer by Profession and Writer by passion, which is until she started pursuing full-time writing. She's presently working as a Financial Content Writer, with a keen interest in all things related to the Insurance Sector.