All About Solvency Ratio for Life Insurance

Blog Title

30981 |

9/9/25 8:26 AM |

Finding the right life insurance plan to secure your family can be a stressful ordeal. This is especially true if you are not knowledgeable about the insurance sector and the metrics that are used to determine a company’s trustworthiness.

One of the first questions to pop-up in your mind will be, “How do I know if an insurance company is good?”

There are multiple parameters that you need to consider before you can find a good insurer to secure your loved ones. And one of the most important factors to consider while evaluating any insurer is their solvency ratio.

What is Solvency Ratio in Life Insurance?

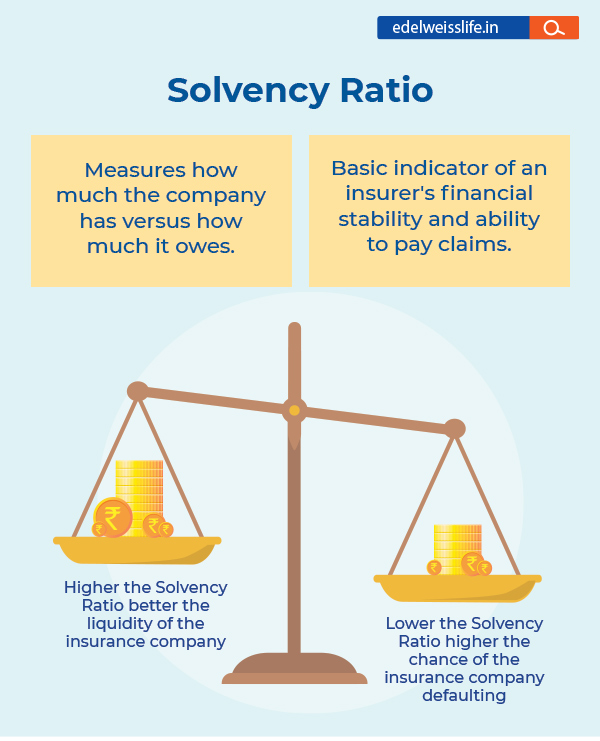

The solvency ratio of an insurance company is how much capital it has compared to the risk it has taken on. The risk is calculated by subtracting liabilities from total assets. In other words, solvency measures how much the corporation has versus how much it owes. It is a basic indicator of an insurer's financial stability and ability to pay claims. Investors can use it to see if the company can meet its obligations, like a bank's capital adequacy ratio.

It is important to note that solvency and liquidity are not synonymous. Liquidity shows if a company can pay short-term debt. Solvency shows if it can pay all debt, including long-term debt. It indicates the firm's long-term viability.

Why is Checking the Solvency Ratio Important?

When buying a life insurance plan, it's important to check the solvency ratio of the company. This ratio shows how much money comes in and out, as well as the company's overall liabilities. The ratio helps customers choose insurance companies that handle claims and financial responsibilities appropriately.

Higher solvency ratios mean it's more likely to pay claims and handle financial costs. The higher the solvency ratio, the better it is for policyholders as well. However, if the solvency ratio is low, the insurance company may struggle to meet financial obligations and pay claims at the same time.

Insurance companies receive innumerable claims regularly. Hence, paying claims and taking care of other financial responsibilities requires suitable financial capabilities.

What is the Importance of Solvency Ratio for the Policyholder?

When it comes to any financial institute, the best way to evaluate their worth is to determine their financial strengths and weaknesses. In the case of life insurance providers, solvency ratio signifies their financial strength.

When a company’s solvency ratio is high, one can assume that they will be able to pay-off their pending claims, even in the event of a loss or poor performance in a given financial year. However, a low solvency ratio signifies financial weakness, indicating that the insurer might not be able to pay death benefits and other claims in case of financial losses.

Hence, as a person looking for financial security for your family, you need to look for insurers with a high solvency ratio. The higher the ratio the better the company’s long-term financial health, and the more capable they will be to settle any claims made by your family in case of your untimely death.

Key Takeaways:

Solvency ratio is an important parameter to consider when choosing an insurer as, in case of your unfortunate demise,

- An insurance company with a low solvency ratio might postpone or struggle to pay you or your family.

- On the other hand, an insurance company that has a high solvency ratio will provide compensation to you and your family.

Example

Let's look at an example to see the importance of solvency ratio:

Neha obtained a life insurance policy from an insurer. In case of her unfortunate demise, the insurance company promises to pay a sum assured as the death benefit to her nominee(s). Let's say such a tragedy comes to pass, and her nominee files a claim. If the company's solvency ratio is low, then it might struggle to make the payout, as the number of claims at any given point is always high. Thus, to ensure that your nominee is financially secure in your absence, you must check the solvency ratio of the insurance company, among other factors.

How is Solvency Ratio Calculated?

The calculation of the solvency ratio uses the following formula:

Solvency Ratio = (Net Income + Depreciation) / Liabilities

The solvency ratio formula compares a company's cash flow against the money it owes as the total sum assured . The higher the solvency ratio, the more assets there are compared to obligations.

What is a Good Solvency Ratio for Insurance?

The IRDAI marks solvency ratio as a key parameter for insurance companies, mandating the maintenance of a ratio of 1.5 for every insurance company with a solvency margin of 150%. It is something that every insurer should abide by. Yet, even within these limits, individual life insurance providers differ in their ranking. To find the best life insurance company for you, check the solvency ratios of all registered insurers on the IRDAI website's annual report.

Types of Solvency Ratios and Their Positive Indicators

There are multiple types of solvency ratios that can be used to determine a company’s long-term financial health. However, in India, and especially for insurers, the solvency ratio that is usually disclosed is the Interest coverage ratio. The other types of solvency ratio are debt-to-assets ratio, equity ratio, and debt-to-equity (D/E) ratio.

Interest Coverage Ratio

The most commonly used type of solvency ratio in India, the interest coverage ratio helps you determine a company’s long-term capabilities of paying off its debts.

The formula for this ratio is the same as given above:

Solvency Ratio = (Net Income + Depreciation) / Liabilities

A ratio of 1.5 or higher indicates that the company is financially healthy and capable of paying its debts, while a ratio below 1.5 is a worrying sign that indicates financial weakness.

Debt-to-Assets Ratio

A simple way to calculate a company’s solvency ratio is to divide its total debts by its total assets.

Debt-to-Assets Ratio = Debt/Assets

A ratio above 1.0 indicates that the company is heavily funded via debts/loans and hence might have difficulties settling their claims and other financial obligations. A ratio below 1.0 is preferable when considering the debt-to-assets ratio.

Equity Ratio

This ratio specifically considers the equity held by shareholders.

Shareholder Equity Ratio = Total Shareholder Equity/Total Assets

A higher ratio means that the company is funded more by equity than by debt. On the other hand, a lower number shows that the company’s debts may be greater than its equity.

Debt-to-Equity Ratio

Similar to the debt-to-asset ratio, the debt-to-equity ratio aims to determine the weightage of debt on the company’s financial health.

Debt-to-equity ratio = Outstanding Debt/Equity

Once again, a higher number indicates high levels of debt. A lower number is preferable since that means that the company’s equity is more important to its financial stability than its debt.

How Can You Check Solvency Ratio of an Insurance Company?

You can check an insurance company’s solvency ratio on their official website. Most companies share their solvency ratio on their about us page, in their public disclosure, or in the footer section of their website. Alternatively, you can find the entire list of insurance providers in India on IRDAI’s website. The IRDAI website will also share important metrics such as the company’s claim settlement ratio, market share, and their solvency ratio.

What is the solvency ratio of Edelweiss life insurance?

IRDAI mandates that all life insurers need to have a solvency ratio above 1.5. Staying in compliance with this mandate, Edelweiss Life Insurance has maintained a solvency ratio of 1.81 as of March 2025.

Conclusion

Customers should always check the solvency ratio with care if they purchase insurance. It matters since the inability of an insurance company to settle claims swiftly and tackle financial responsibilities defeats the core purpose of insurance on multiple levels.

While the Claim Settlement Ratio and Turn Around Time are vital aspects to consider when selecting an insurance company, you should also keep the Solvency Ratio in mind. A term insurance policy is your way of ensuring your family's future in your absence. So, make sure you make an educated decision before purchasing any insurance policy.

FAQs

What does solvency mean?

Solvency refers to a company’s (or person’s) ability to pay off their debts.

What if an insurer has a low solvency ratio?

Lower solvency ratio means that the insurer has high debt, which can affect their ability to pay off claims made by nominees.

Can the solvency ratio of an insurer change?

Yes, solvency ratio changes regularly. Each insurance provider shares their solvency ratio for a given financial year in their public disclosures.

What factors can impact the solvency ratio of an insurance company?

A company’s solvency ratio is affected by multiple factors such as their debt ceiling, their profitability, their cash flow, and their annual expenditure.

What is a reasonable solvency ratio for an Insurance Company?

As per the requirements of IRDAI, insurance companies must maintain a solvency ratio of 1.5. Anything higher than this is considered a good solvency ratio.

What is liquidity ratio or solvency ratio?

Liquidity and Solvency are two separate parameters. While Liquidity is the ability of an insurer to pay off short-term liabilities, Solvency takes into account long-term debts as well.

Is a high solvency ratio good or bad?

High solvency ratio is an indicator of an insurer’s good financial health. You should choose an insurance company with a high solvency ratio.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.