Tax benefits of ULIPs Under Section 80C

Blog Title

4674 |

11/21/22 5:15 AM |

A Unit-Linked Insurance Plan, popularly known as a ULIP is an insurance plan that offers the dual benefit of investment to fulfil your long-term goals, and a life cover to financially protect your family in case of an unfortunate event. A term insurance plan offers life cover; similarly, a mutual fund investment offers you an opportunity to create wealth with market-linked performance. However, with a ULIP, you get the benefits of both market-linked wealth creation and life insurance cover, as well as tax benefits.

Among the many investor-friendly features that ULIPs provide, the first one that stands out is the opportunity you get to invest a portion of the policy premium in a diverse pool of funds. These funds can be equity, debt, or a mix of the two. Additionally, some ULIPs offer you inter-fund transfers using the fund-switching feature without incurring additional charges. This means you can invest your money in equity or debt in any proportion you want and then redirect the investment amount as per the market performance of the funds.

Furthermore, ULIPs are also very dependable life insurance products as they give you the advantage of life insurance. You get life cover for a sum assured, which your receive in case of your unfortunate demise.

Lastly, there is no doubt that are a crucial element that distinguishes them. However, the most recent changes made as part of Budget 2021–22 have somewhat changed the tax advantages of ULIP plans. Nevertheless, ULIPs continue to have benefits that solidify their place as a investment option even after the planned adjustments. Therefore, while a lot is said about the insurance and investment components of ULIPs, the latest changes in the tax regime warrant a deep discussion of their taxation.

Here is everything you need to know about and the implications of Budget 2021-22 on their taxation:

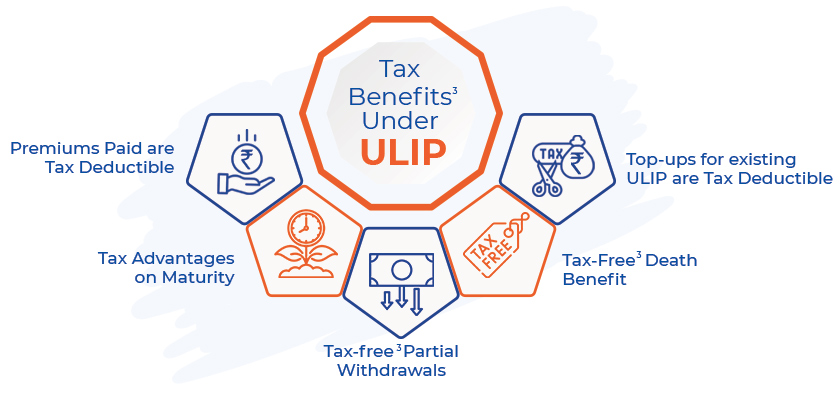

The 5 Tax Advantages of ULIPs

From providing tax savings on all three stages of an insurance policy, namely the premium, proceeds, and returns, to providing additional tax benefits such as tax-free switches and premium top-ups, ULIPs are a good choice to save taxes. Here are the five tax benefits offered by ULIPs, discussed in detail.

Premiums Paid are Tax Deductible.

The annual premium you pay for a ULIP is tax deductible (up to 1.5 lakh) as per the Income Tax Act, Section 80C.

ULIPs provide tax advantages upon maturity.

The conclusion of your policy is referred to as maturity. At maturity, you get the sum assured or the total value of your corpus (whichever is higher). The maturity amount in a Unit Linked Insurance Plan (ULIP) is fully excluded from Income Tax if conditions under Section 10(10D) are satisfied.

A ULIP allows for tax-free partial withdrawals.

After completing your ULIP's 5-year lock-in period, you can make tax-free partial withdrawals if .

The death benefit of a ULIP is tax-free.

The death benefit payable to your nominee/family members under a ULIP is also exempt from taxationSection 10D). This benefit includes the sum assured and the returns generated by the plan's market-linked assets.

Top-ups made under an existing ULIP plan are tax deductible.

After the 5-year lock-in period, you can make top-up investments or cash additions (over your premiums) to your ULIP. These top-ups are tax-deductible under Sections 80C.

What are the changes to ULIP taxation implemented in Budget 2021-22?

Budget 2021-22 recommended various reforms in ULIP taxation to level the playing field for ULIPs and other equity-linked market products. According to the new tax rules, new ULIP plans issued on or after February 2021 will be if the annual premiums exceed 2.5 lakhs. Such ULIPs will fall outside the ambit of section 10(10D) and would be subject to capital gain tax in the hands of the policyholder. In case of long term gains (ULIPs held >12 months), the tax rate applicable is 10% on gains above Rs 1 lakh. In case of short-term gains (ULIPs held <12 months), the tax rate applicable is 15% on overall gains. However, no taxes are applicable in case of death of the insured. Also where ULIP policies fall below the 2.5 lakh premium threshold, exemption is available on satisfaction of section 10(10D) criteria.

What are the implications of the new ULIP taxation rules for investors?

The tax burden has primarily altered for high-net-worth investors with yearly premiums of more than 2.5 lakhs. Low-net-worth investors who pay annual premiums of less than 2.5 lakhs continue to benefit from the same tax breaks as before the Budget 2021-22 revisions. Their premiums, maturity and death benefits, withdrawals, and capital gains are tax-free. Even high-net-worth individuals can reap the same benefits if their annual premiums (annual premium per policy or aggregate annual premiums per policyholder) do not exceed Rs. 2.5 lakh.

Are ULIPs still a viable investment option?

Despite the new taxation regime, ULIPs continue to be an appealing investment alternative as they combine the security of life insurance with higher investment returns. This protects your family while also providing you with healthy long-term returns.

Secondly, ULIP premiums are tax deductible and the death benefit continue to be tax-free. However, the maturity benefit is only taxable if the annual premiums surpass 2.5 lakhs.

Third, unlike complicated equity-linked investing options, ULIP plans are simple to grasp. As an investor, you will also have an easy time matching your fund allocation to your risk tolerance and financial goals.

Conclusion

ULIPs remain a popular investment choice among investors due to their dual advantages of investment and insurance. If your goal is the long-term creation of wealth and tax savings, then they are the ideal choice.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.