Budget 2024-25: How TDS Cuts on Life Insurance Payouts Benefit You

Blog Title

5593 |

7/29/24 5:11 PM |

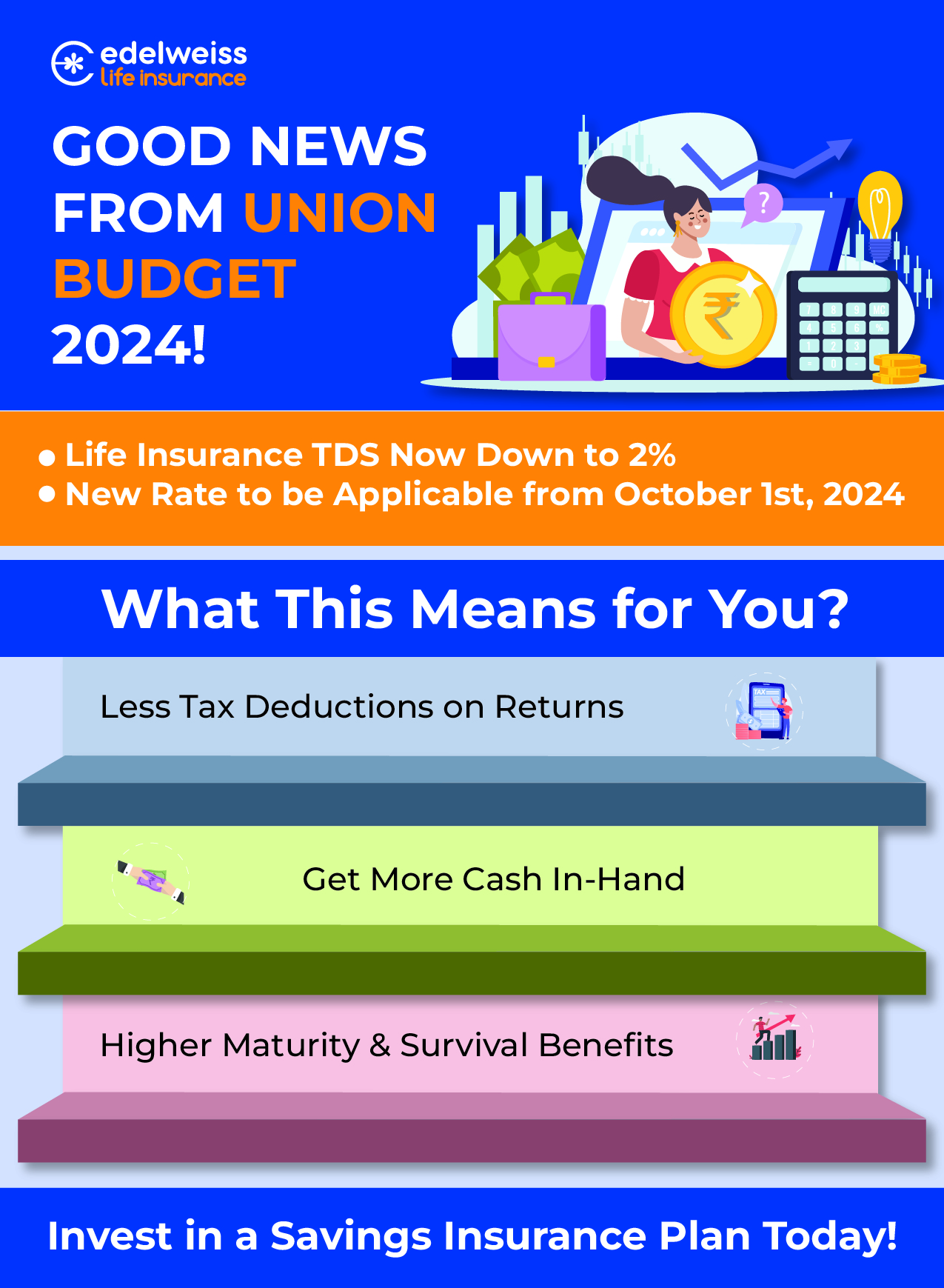

Life Insurance policies have just become even more lucrative for policyholders! If you have an endowment insurance plan, then expect your payouts/survival benefits to increase after October 1st, 2024. As per the latest Union Budget 2024-25 discussion held on July 23rd, Tax Deduction at Source (TDS) for all life insurance plans has reduced from 5% to 2%. This means more cash-in-hand for you and your loved ones when your policy matures, or a claim is made!

Explaining TDS on Life Insurance

Life Insurance TDS Rules Before Budget 2024

As per Section 194DA of the Income Tax Act, life insurance payouts are subject to tax deductions at source if the bonus/returns payable are greater than ₹1,00,000. Before budget 2024, 5% of your returns would have been deducted during the payout process.

Changes to Life Insurance TDS Announced During Budget 2024

Thanks to the new provisions under Budget 2024, TDS on life insurance plans has now reduced to 2%. This means that the value of your insurance returns will significantly improve! If you still haven’t invested in an insurance plan, then NOW is a better time than any!

When is TDS Not Applicable?

Note that tax deduction at source is not applicable for life insurance plans that are exempt under Section 10(10D). However, not all plans meet the requirements for tax exemptions listed under 10(10D). Your plan will only be tax exempt if it meets the eligibility criteria listed below:

For policies purchased between April 1st, 2003, and March 31st, 2012, premiums paid in a year should not exceed 20% of the sum assured.

For policies purchased after April 1st, 2012, premiums in a year should not exceed 10% of the sum assured.

For ULIPs purchased after February 1st, 2021, the annual aggregate premium paid (total premiums for all ULIPs purchased by you) should not exceed ₹2.5 lakhs.

Example of How Life Insurance TDS is Calculated

Let’s say you pay a premium of ₹1 lakh for 5 years, amounting to a total premium of ₹5 lakhs. Then after 10 more policy years, you receive a maturity benefit of ₹20,00,000. TDS on life insurance is only calculated on your net income, meaning that your premiums will be deducted from the total returns.

Net Income = Maturity Amount – Total Premiums Paid = ₹20,00,000 – ₹5,00,000 = ₹15,00,000

So, TDS will only be calculated on your net profit of ₹15 lakhs.

Before Budget 2024 Changes

5% will be deducted from your income:

TDS= 5% of ₹15,00,000 = ₹75,000

In-Hand Returns = Net Income – TDS = ₹15,00,000 – ₹75,000 = ₹14,25,000

So, your in-hand payout will be ₹14,25,000.

After Budget 2024 Changes

Post October 1st, 2024, your life insurance TDS will only be 2%.

Based on the new provision, your TDS will be:

TDS= 2% of ₹15,00,000 = ₹30,000

In-Hand Returns = Net Income – TDS = ₹15,00,000 – ₹30,000 = ₹14,70,000

So, your in-hand payout will be ₹14,70,000

This is a net increase of ₹45,000!

Who Will Benefit from this New TDS Rates on Life Insurance Payouts?

While the first Budget 2024 change pertains to insurance policyholders, the second change will be applicable to brokers and insurance agents. Most people purchase life insurance through a trusted broker/agent, and agents receive a commission upon the sale of a policy. Under Section 194D, all insurance commissions are subject to a TDS of 5%.

However, insurance agents will soon enjoy a higher commission payout. Budget 2024 also announced a reduction on TDS under Section 194D, with rates going down to 2% from 5%. This change will take a bit longer to come into effect, as the current tentative date for the new TDS is April 1st, 2025.

Other Tax Benefits Applicable to Life Insurance

Another major benefit of life insurance is that your premiums are applicable for tax deductions. Under Section 80C of the Income Tax Act, you can annually deduct up to ₹1.5 lakhs from your taxes. Note that the ₹1.5 lakh limit applies to all potential deductions, including life insurance premiums, ELSS payments, National Savings Certificate payments etc.

Additionally, your life insurance death benefit is always tax exempt under Section 10(10D)! So, irrespective of how much you invest, your life cover will always be paid in full to your loved ones.

Conclusion

The new TDS rates make life insurance one of the most tax friendly investments out there. Moreover, endowment insurance plans not only offer wealth growth but also ensures your family’s financial security. If you wish to secure your loved ones while also growing your wealth for years to come, then consider looking into Edelweiss Life- Flexi-Savings Plan.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.