Limited Pay in Term Insurance Plans in India

Blog Title

2381 |

2/25/20 9:27 AM |

All you need to know about Limited Premium Payment

Imagine you are well into your 60’s. You are sipping sugarless tea in your balcony on a pleasant Tuesday evening. There’s music playing on your iPhoneXX. A reminder to pay premium for your life insurance premium interrupts it. No one likes interruptions. And especially interruptions of payment due reminders.

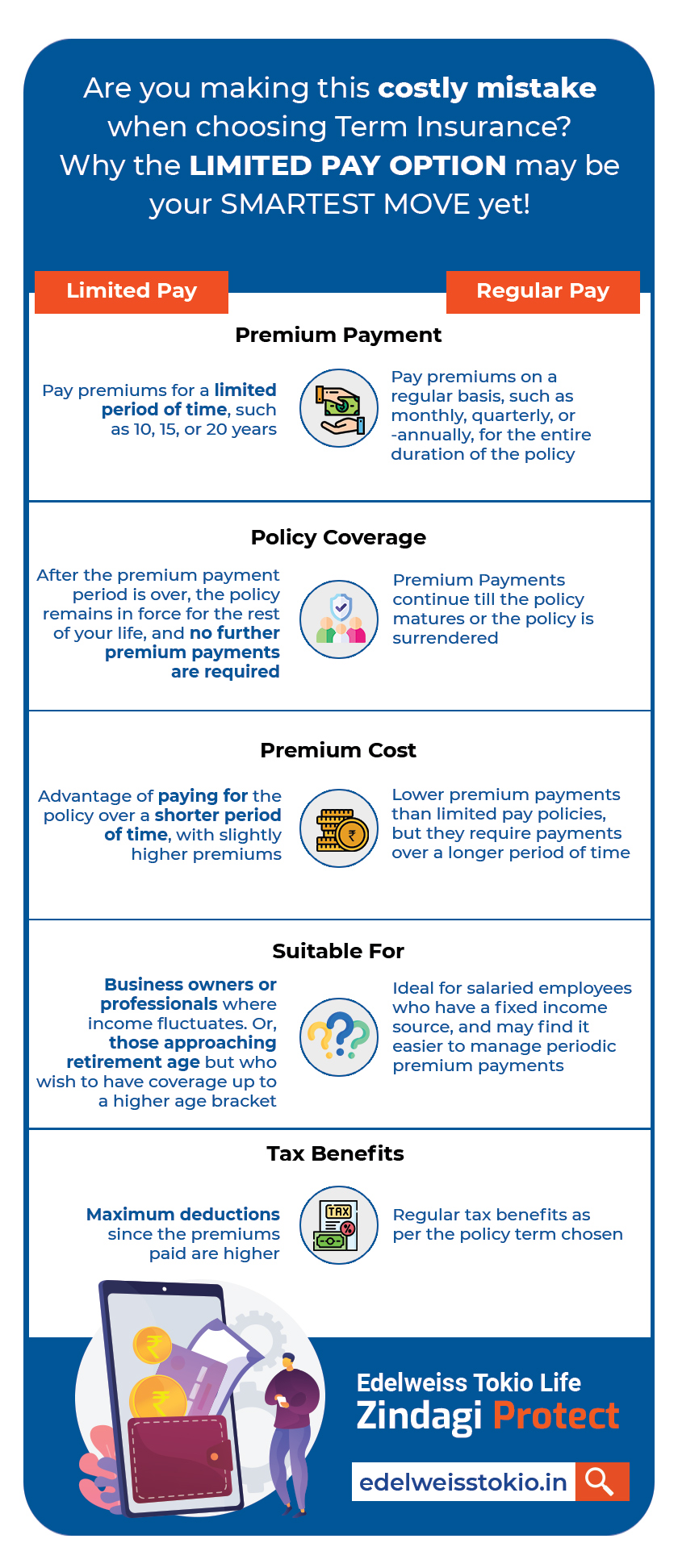

Enter – The Limited Pay Option

There is a way to pay off your premiums before you retire! Most Indian Life Insurance companies have introduced a new premium payment option – Limited Pay. The Limited Pay option frees you from paying premiums for the entire policy term. Typically, the premium payment term using limited pay ranges between 5 to 40 years.

Advantages of a Limited Pay Option

Limited pay is becoming increasingly popular among people looking for best life insurance plans in India, because:

Liability-free Retirement

We all want a hassle-free retirement without the worry of paying EMIs or premiums. With the limited pay option you can pay off premiums as early as you want. And enjoy a longer life cover which may last for 85 to 100 years.

Cheaper Premiums

Suppose you are 30 years of age. You want to buy a Life Insurance till the age of 80 i.e 50 years from now. Suppose your premium is ₹10,000, your total premium amounts to ₹5 lakhs. But, with the limited pay option your total premium may approximately be ₹3.8 lakhs. The overall premium amount through the limited pay option is approximately 25% lesser than the regular pay option.

Better Tax Benefits

When you choose a limited pay option your annual premium increases. You are essentially paying for a shorter duration for a longer policy term. This lets you maximize the deduction available under Section 80C of the Income Tax Act.

Decreased chances of Policy Lapse

Another great advantage is that the chances of a policy lapse are low. Because, you pay the premiums during the years you earn. You need not worry about inadvertently missing a payment in your later years.

Conclusion

One can go ahead with the limited premium term plans in case he/she wants to enjoy the benefits of an insurance cover without being burdened with the struggle of paying prolonged premiums year on year.