Pos Saral Nivesh

Menu Display

- Customer Service

- Our Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

New Launch

- Edelweiss Life - Guaranteed Flexi STAR - Assured¹ Savings Plan

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

- Resume Application

- Insurance Guide

- Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

- About Us

Menu Display

-

Customer Service

-

Our Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

New Launch

- Edelweiss Life - Guaranteed Flexi STAR - Assured¹ Savings Plan

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Assured Income STAR - A Regular Guaranteed¹ Income Plan

-

Resume Application

-

Insurance Guide

-

Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

Menu Display

Breadcrumb

Pos Saral Nivesh

Thank you!!

Thank you for sharing your details with us.

Our Investment expert will get in touch with you soon to understand your life insurance needs.

Internal Server Error, Please try again after some time.

Need Assistance?

Fulfillment Of Your Goals, Guaranteed.¹

protection and savings that ensures that you lead a secured and

peaceful life with complete certainty!

Product Enquiry

Take a step ahead to grow your savings

No response from Server, Please try again.

Thank you!!

Thank you for sharing your details with us.

Our product expert will get in touch with you soon to understand your life insurance needs.

Pos Saral nivesh sticky menu

POS Saral Nivesh brouchure

A Multiple of single/annualized premium as life cover at all time during policy tenure

Product Prospectus

View Download

View Download

Sample Contract

View Download

View Download

Rate Table

View Download

View Download

Customer Information Sheet

View Download

View Download

Reasons Why This Plan Is A Guaranteed¹ Success

Reasons Why This Plan Is A Guaranteed¹ Success

No Surprises Here!

This plan has the advantage of letting you know exactly what kind of returns you get upon investing.

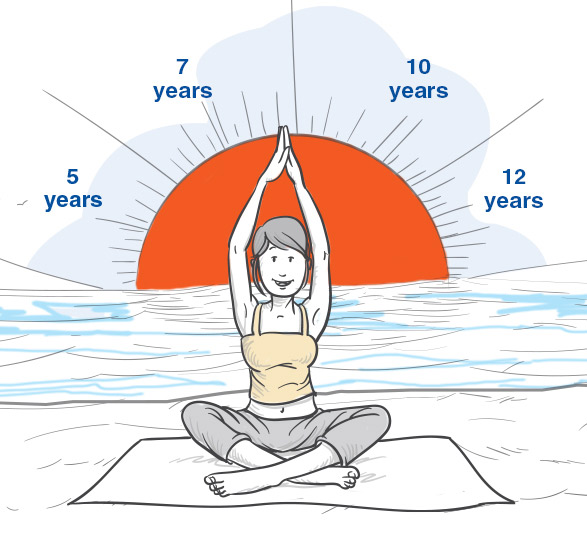

Limited Pay Plan

You can complete all your premium payments in 5, 7, 10 or 12 years and enjoy your plan benefits until 65 years.

For unforeseen times

You have the option to avail a loan² on your policy to deal with any unexpected emergencies.

Discounts⁴ up to 13%

Get discounts⁴ up to 13% when you opt for a higher Sum Assured.

Benefits of POS Saral Nivesh

Benefits of POS Saral Nivesh

-

Guaranteed¹ Benefits

No surprises here! With Edelweiss Life POS Saral Nivesh, get guaranteed¹ benefits on your investment. The advantage with this plan is that you know exactly how much you’re getting out of it, so you can plan your future goals accordingly

-

Discounts⁴ on Higher Sum Assured

Those who aim higher get better rewards! When you opt for a higher Sum Assured, we reward you with discounts, ranging from 3% to 13%

-

Limited Pay

Don’t spend your retirement paying off premiums! With the Limited Pay Option, you can complete all of your premium payments in 5, 7, 10 or 12 years (depending on your policy term) and enjoy your benefits till the end of the policy term, up to 65 years.

-

Simplified Purchase

Let’s make things simple! This plan is designed to help you make an informed decision through an uncomplicated process. This is why you can plan your future needs in just a few steps

-

Loan² Facility

Don’t let financial trouble stop you from your goals!We want you to live your zindagi unlimited, even if you need a little support to do it. That is why this plan offers you the choice to avail a loan² for urgent need of cash flow.

-

Tax Benefits³

No deductions, no worries! That is why the premiums you pay are eligible for deductions under section 80(C) and the returns you get from it are exempt from taxes under section 10(10D)

Guaranteed¹ Benefits

No surprises here! With Edelweiss Life POS Saral Nivesh, get guaranteed¹ benefits on your investment. The advantage with this plan is that you know exactly how much you’re getting out of it, so you can plan your future goals accordingly

Discounts⁴ on Higher Sum Assured

Those who aim higher get better rewards! When you opt for a higher Sum Assured, we reward you with discounts, ranging from 3% to 13%

Limited Pay

Don’t spend your retirement paying off premiums! With the Limited Pay Option, you can complete all of your premium payments in 5, 7, 10 or 12 years (depending on your policy term) and enjoy your benefits till the end of the policy term, up to 65 years.

Simplified Purchase

Let’s make things simple! This plan is designed to help you make an informed decision through an uncomplicated process. This is why you can plan your future needs in just a few steps

Loan² Facility

Don’t let financial trouble stop you from your goals!We want you to live your zindagi unlimited, even if you need a little support to do it. That is why this plan offers you the choice to avail a loan² for urgent need of cash flow.

Tax Benefits³

No deductions, no worries! That is why the premiums you pay are eligible for deductions under section 80(C) and the returns you get from it are exempt from taxes under section 10(10D)

Only 4 Steps Are Needed For You To Get This Plan!

Only 4 Steps Are Needed For You To Get This Plan!

Start Making Decisions

- Conduct Need Analysis

- Choose your Premium Amoun

Choose Your Terms

- Select your Policy Term

- Select your Premium Paying Term

Select what is best for you

- Choose guaranteed maturity benefits

- Choose a higher sum assured to get a discount⁴

Sit Back and Relax

- Submit the requested documents

- Let us verify your details so you can start getting guaranteed¹ benefits!

Asset Publisher

More Products You'd Love to Explore

Har Sapna Karo Poora with Guaranteed¹ Savings!

Guaranteed¹ returns, enhanced cover option, tax benefits³, and more… all with premiums just Rs. 3,000/month^².

Choice to receive guaranteed¹ returns as lumpsum or in 5 equal annual instalments

Enhanced Cover option to secure your family with 20x the premium^⁴ paid

Guaranteed¹ savings & life cover for a policy term as high as 40 years

Family Income Benefit option to ensure your family doesn’t have to compromise on dreams

Need expert advice

Need expert advice?

Reasons Why You’re Bound to Love Us Back

Reasons Why You’re Bound to Love Us Back

We want our customers to be financially secured and enable them to achieve their financial goals.

We have the expertise in making you grow your wealth.

We constantly innovate our offerings to get better results to secure your future.

Reasons Why You’re Bound to Love Us Back

We want our customers to be financially secured and enable them to achieve their financial goals.

We have the expertise in making you grow your wealth.

We constantly innovate our offerings to get better results to secure your future.

Here's Why Our Customers Adore Us

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

Thank you so much Vaishali, I’m fully satisfied with the resolution you provided me, once again thank you & have a good day.

HETAL N PATEL

(Customer)

Thank you so much Adil, you have cleared all my queries & I have completely satisfied the information you have provided me thank you so much.

AJAY KUMAR SHARMA

(Customer)

Thank you so much; I appreciate that you have shared the best resolution with me. I am now satisfied with the information you provided. Once again, thank you, Adil.

CHAITALI GUPTA

(Customer)

I had called multiple times and the issue couldn't be resolved, but this time it has been resolved clearly. Your assistance is greatly appreciated. Thank you so much, Ekta.

K V PAVAN

(Customer)

Adil sir, well done. You spoke to me very nicely and explained everything clearly. I really appreciate your help. Thank you so much.

KETKI YOGESHKUMAR GAJJAR

(Customer)

You have resolved my queries and doubts very well, and I am very satisfied with your service. Thank you so much, Adil sir.

Deepak Jaysingrao Sarnaik

(Customer)

I appreciate you, Adil. Thank you so much for helping me.

JOHN THOMAS

(Customer)

You have resolved all my queries, Thank you so much Adil.

LAXMI

(Customer)

You listened to my queries patiently and resolved them very well. Thank you so much.

VEENA SHARMA

(Customer)

Thank you so much Roshan, you cleared all my queries once again Thank you and have a great day.

JAYALAKSHMI UDAYAKUMAR

(Customer)

Thank you so much for the clarification. No one has ever explained it to me this clearly before. All my doubts are now resolved. Thank you, Divya!

K SURESH KUMAR REDDY

(Customer)

Ekta, I truly appreciate the information you provided. No one has guided me this way before. You are an excellent advisor for the organization—very intelligent—and I am completely satisfied with your resolution. Once again, thank you so much! Ekta

Ranganayaki Rajagopalan

(Customer)

Dear, your very helpful and I really very appreciate the way you handle all my queries and resolve it, Thank you so much Sahil.

SUSHMA SHARMA

(Customer)

Thanks for your quick response. I highly appreciate your patience and simple way of explaining my fund situation to me. Thanks for helping ease my anxiety and trouble faced for the last 6 months, Jaydev. Thanks again for your help, Jaydev

SHRADDHA SHETTY

(Customer)

You are very very co-operative and nice, I’m very appreciate your work and very much thankful to you. Have a nice day Roshan.

Kimberleydeanne Sanjay Paes

(Customer)

You did a great job by providing all the necessary information. Thank you so much, Roshan.

Lejoy Daniel

(Customer)

Thank you Meenakshi, I really appreciate your efforts to make me understand. Thank you so much.

Shrawan Ram

(Customer)

Thank you. I appreciate the way you explained the policy details to me. It was really good talking with you Narmin.

Satya Prakash Singh

(Customer)

Thank you. It's great that you provided me with all the information. Have a nice day sahil and thank you so much.

Atul Shashikant Sakharkar

(Customer)

Thank you. The query I had was very well resolved by you. Thank you so much.

Mohit Munshi

(Customer)FAQs Saral Nivesh

FAQs

Like teachers say, there are no silly questions

Why do I need a savings plan?

In today’s uncertain world, it is important to save for the rainy days. You need to arrange for stable funds to fulfill your ambitions and to support you in your later years. A savings insurance plan ensures that your family’s future is secured, even in uncertain times.

Was this helpful?

Why should I opt for Edelweiss Life POS Saral Nivesh?

This plan offers you dual benefits of protection and savings and ensures that you lead a secured and peaceful life with complete certainty. It helps you move systematically towards a secured future by offering you guaranteed benefits. It ensures your family is always financially protected in case of any unforeseen event.

Was this helpful?

What goals can I achieve with this plan?

Whether it is taking care of your family’s future, saving for retirement or any other important milestone, Edelweiss Life POS Saral Nivesh will take care of all your financial goals with guaranteed returns.

Was this helpful?

Does this plan cover COVID-19 claims?

Yes, this plan covers death due to COVID-19.

Was this helpful?

What is a limited pay plan?

A limited pay plan lets you pay your premiums in a shorter span, while you are still earning. This means that you don’t have the burden of premium payment in your later years and can enjoy a liability-free retired life.

Was this helpful?

What is the minimum and maximum entry age?

The minimum entry age is 1 year, and maximum entry age is 50 years.

Was this helpful?

What is the minimum and maximum maturity age?

The minimum maturity age is 18 years and maximum maturity age is 65 years.

Was this helpful?

What is the minimum and maximum policy term?

The minimum policy term is 10 years and the maximum policy term is 20 years.

Was this helpful?

How long do I need to pay my premiums and at what frequency?

You can pay your premiums for 5, 7, 10 or 12 years. You can choose the payment frequency as either annual or monthly.

Was this helpful?

What is the minimum and maximum sum assured?

The minimum sum assured is ₹50,000 and the maximum sum assured is ₹25 lakhs.

Was this helpful?

Are there any discounts available?

If you choose a higher Sum Assured on Maturity, we will offer you a discount on your premium amount.

Was this helpful?

Is there a loan facility available with the plan?

Yes, you can get a policy loan once policy acquires surrender value.

Was this helpful?

Does this plan have a Maturity Benefit?

Yes, this plan does come with a maturity benefit. At the end of your policy term, you will receive the Guaranteed Maturity Benefit provided all due premiums have been paid in full and the policy is in-force. Your Guaranteed Maturity Benefit is equal to the Sum Assured on Maturity.

Was this helpful?

Does this plan have a Free Look Period?

You have a freelook period of 30 days from the date of the receipt of the policy document for the policy issued after 1st April, 2024 and processing TAT for same is 7 days.

Was this helpful?

Are there any Exclusions to this plan?

In case of death due to suicide within 12 months from the risk commencement date or from the date of revival of the policy, your beneficiary shall be entitled to receive at least 80% of the Total Premiums Paid, provided the policy is in in-force.

Was this helpful?

Does this plan have a Grace Period?

Does this plan have a Grace Period?

Grace period of 15 days, where you pay the Premium on a monthly basis, and 30 days in all other cases, is available.

Was this helpful?

Dhan Labh any queries

We are always there for you !

For queries, write to [email protected]

Related Articles & Resources

Pos Saral Nivas Video Slider

Videos

0- Provided the premium paying term is more than or equal to 10 years.

1- This is applicable only if all due premiums are paid and the policy is inforce.

2- Policy loan are subject to terms & conditions of the product. Refer product brochure for more details.

3- As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

4- Subject to Term & Conditions. Please refer product brochure for more details

Edelweiss Life - POS Saral Nivesh is an Individual, Non-Linked, Non-Participating, Savings, Life Insurance Product. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary. Tax benefits are subject to changes in the tax laws.

For more details on risk factors and terms and conditions, please read sales brochure carefully before concluding a sale.

Flower & Edelweiss (as displayed above) are trademarks of Edelweiss Financial Services Limited used by Edelweiss Life Insurance Company Limited under license.

Edelweiss Life Insurance Company Limited (formerly known as ‘Edelweiss Tokio Life Insurance Company Limited’).

IRDAI Reg. No.: 147. CIN: U66010MH2009PLC197336| UIN: 147N038V05 | ARN. NO : WP/3941/Oct/2024

Registered & Corporate Office: 6th Floor, Tower 3, Wing ‘B’, Kohinoor City, Kirol Road, Kurla (W), Mumbai 400070.

Toll Free No.: 1800 212 1212 | www.edelweisslife.in

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. |