Easy Pension

Menu Display

- Customer Service

- Our Products

- Edelweiss Life - Guaranteed Flexi STAR - A New Assured¹ Savings Plan

New Launch

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Guaranteed Flexi STAR - A New Assured¹ Savings Plan

- Resume Application

- Insurance Guide

- Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

- About Us

Menu Display

-

Customer Service

-

Our Products

- Edelweiss Life - Guaranteed Flexi STAR - A New Assured¹ Savings Plan

New Launch

- Edelweiss Life – Wealth Rise+ - A Double - Advantage ULIP

- Edelweiss Life – Wealth Plus - A Savings, Insurance & Child Benefit Plan

- Edelweiss Life - Zindagi Protect Plus - A Comprehensive Term Plan

New Term Plan

- Edelweiss Life - Premier Guaranteed Star

- All Products

- Edelweiss Life - Guaranteed Flexi STAR - A New Assured¹ Savings Plan

-

Resume Application

-

Insurance Guide

-

Knowledge Center

- Savings Plans

- Life Insurance

- Term Insurance plans

- Unit Linked Insurance Plans

- Guaranteed Income Plans

- Retirement Insurance

- Health Insurance Plans

- Child plans

- Insurance Fraud Awareness

- Covid Insurance

- NRI Insurance

- Investment Plans

- Endowment Plans

- Group Insurance

- Micro Insurance

- Sabse Pehle Life Insurance

- Income Tax

Menu Display

Breadcrumb

The Easy Way To Plan Your Pension!

financially protected, stable and happy retired life..

Product Enquiry

Take a step ahead to secure your retired life

No response from Server, Please try again.

Thank you!!

Thank you for sharing your details with us.

Our product expert will get in touch with you soon to understand your life insurance needs.

Easy Pension Web Nav

Easy Pension Product Brochure

A Multiple of single/annualized premium as life cover at all time during policy tenure

Product Brochure

View Download

View Download

Sample Contract

View Download

View Download

Customer Information Sheet

View Download

View Download

Reasons Why This Plan Makes Retirement Easy!

Reasons Why This Plan Makes Retirement Easy!

The One till 85!

We’ll stay by your side and provide you with protection and retirement solutions till you’re 85 years old.

Something More’ is always better

We’ve got Guaranteed1 Loyalty Additions and Single Pay Enhancers2 to give you great benefits.

Low Premium Allocation Charge

This plan offers low premium allocation charges..

Lump Sum + Regular Payout

Option to get a part of your fund value as lump sum and the rest of the fund value is invested as an annuity for regular income.

Benefits of Easy Pension Scroll Top

Benefits of Easy Pension

-

Pension bhi, Protection bhi!

Let your future be secured! With this plan, you get the double advantage of retirement solution as well as protection so that you continue to get a steady income in your second innings.

-

Long Life Cover

Life cover jo chalta rahe! This plan will look out for you for a long time by providing you with a life cover till 85 years of age.

-

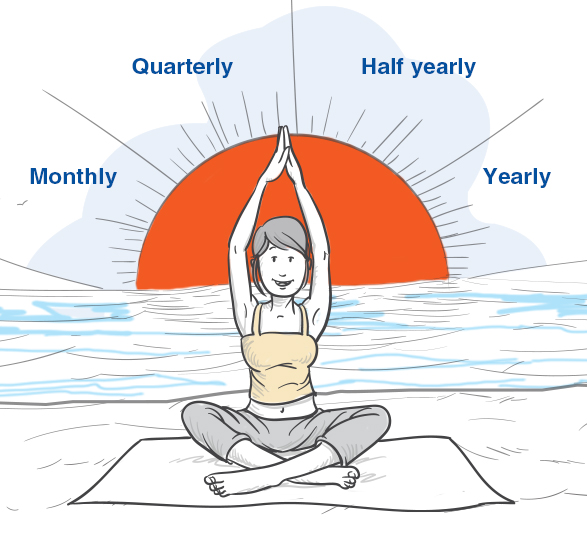

Premium Payment Options

Pay as per your convenience.! With this plan, you can complete all payments in one go through the Single Pay option, or space them out at periodic intervals (Annual, Half-yearly, Quarterly, Monthly) through the Regular Pay option. You can also complete your premium payments early through the Limited Pay option, where you can make your payments over a span of 5 to your Policy Term-5 years.

-

Satisfy Your Risk Appetite

Pick the strategy that works for you! Depending on your needs and risk appetite, we have 2 strategies for you - Aggressive Strategy and Conservative Strategy. Your percentage of investment in the Pension Growth Fund and the Pension Secured Fund is based on the choice you make. This choice needs to be made when you start the policy

-

Low Premium Allocation Charges

Low charges mean more savings! With this plan, you have the advantage of paying low premium allocation charges.

Pension bhi, Protection bhi!

Let your future be secured! With this plan, you get the double advantage of retirement solution as well as protection so that you continue to get a steady income in your second innings.

Long Life Cover

Life cover jo chalta rahe! This plan will look out for you for a long time by providing you with a life cover till 85 years of age.

Premium Payment Options

Pay as per your convenience.! With this plan, you can complete all payments in one go through the Single Pay option, or space them out at periodic intervals (Annual, Half-yearly, Quarterly, Monthly) through the Regular Pay option. You can also complete your premium payments early through the Limited Pay option, where you can make your payments over a span of 5 to your Policy Term-5 years.

Satisfy Your Risk Appetite

Pick the strategy that works for you! Depending on your needs and risk appetite, we have 2 strategies for you - Aggressive Strategy and Conservative Strategy. Your percentage of investment in the Pension Growth Fund and the Pension Secured Fund is based on the choice you make. This choice needs to be made when you start the policy

Low Premium Allocation Charges

Low charges mean more savings! With this plan, you have the advantage of paying low premium allocation charges.

Steps Easy Pention Only 4 Steps Are Needed For You To Get This Plan!

Only 4 Steps Are Needed For You To Get This Plan!

Start Making Decisions

- Conduct Need Analysis

- Choose your Premium Amount

Choose Your Terms

- Select your Policy Term

- Select your Premium Paying Term

Select what is best for you

- Choose your Premium Paying Frequency

- Choose your Risk Strategy

Sit Back and Relax

- Submit the requested documents

- Let us verify your details so you can start saving for retirement

Asset Publisher

Need expert advice

Need expert advice?

What Makes Us Your Ideal Partner

What Makes Us Your Ideal Partner

99.29% Claim Settlement Ratio**

Our Promise of Integrity- 99.29% Claim Settlement Ratio** for FY 24-25

Recognized for Our Remarkable Customer Journey!

'Bolt' wins under 'Public & Private Collaboration' category at NASSCOM Foundation TechForGood Awards 2024^³

What Makes Us Your Ideal Partner

99.29% Claim Settlement Ratio**

Our Promise of Integrity- 99.29% Claim Settlement Ratio** for FY 24-25

Recognized for Our Remarkable Customer Journey!

'Bolt' wins under 'Public & Private Collaboration' category at NASSCOM Foundation TechForGood Awards 2024^³

Here's Why Our Customers Adore Us

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

Thank you Meenakshi, I really appreciate your efforts to make me understand. Thank you so much.

Shrawan Ram

(Customer)

Thank you. I appreciate the way you explained the policy details to me. It was really good talking with you Narmin.

Satya Prakash Singh

(Customer)

Thank you. It's great that you provided me with all the information. Have a nice day sahil and thank you so much.

Atul Shashikant Sakharkar

(Customer)

Thank you. The query I had was very well resolved by you. Thank you so much.

Mohit Munshi

(Customer)

Thank you, the information you gave me is complete & clear, Thank you so much.

Mayur Tiwari

(Customer)

You have given me proper information, I’m very happy the way you’re giving the information & I totally understand, Thank you so much Narmin.

Maddirala Siva Sankararao

(Customer)

You explained the details to me very well, and the information you provided was very clear, Thank you so much.

Deepshikha

(Customer)

Thank you Narmin, you really help me a lot, thank you so much, it’s really good to talk to u, keep going.

Suryabali Sitladin Vaishya

(Customer)

I thank your entire team for their sincere efforts in crediting the amount to my account. I have received the amount and thank you again from the bottom of my heart.

Bishnu Satapathy

(Customer)

Thank you so much Narmin, the information you provided me is really clear & good, Thank you

Christopher Paul Carroll

(Customer)

Thank you Athang, it’s really good to talk to you & you informed me all the details, Thank you so much for your effort.

Manish Kumar Tiwari

(Customer)

10 out 10. Interaction was too good. I got all the details and I’m convinced. I was not sure about this policy details and got very good feedback from your end. Thank you so much!

Mahalakshmi Srinivasan Iyer

(Customer)

It was excellent! The way you (Agent, Divya Patariyar) understood my query and then the way you clarified, I would really thank you for your patience and then hearing me out finding out the problem and then letting me know what’s would happen my policy details thanks it a was great spoke to you I will rate you 5 out 5 !!!

Durga Prasad Arsid

(Customer)FAQs For Easy Pension

FAQs

Like teachers say, there are no silly questions

What is a pension plan?

Pension plans provide financial security post-retirement so you can maintain your lifestyle even in your second innings. They also provide a life cover to protect your family in your absence.

Was this helpful?

Why do I need a pension plan?

In today’s fast paced world, it is becoming increasingly important to plan your life well. Given our hectic work lives today, it is important that you plan for a peaceful and secure retirement in the future. Many of us also plan to retire early and fulfill our unrealized dreams post retirement. It is, thus, necessary to ensure that you have adequate financial resources to enjoy a stress-free post-retirement life.

Was this helpful?

Why should I opt for Edelweiss Life Easy Pension?

Edelweiss Life – Easy Pension is a retirement plan, suited to meet your financial needs for a stable and happy retired life. You have the option to get a part of your fund value as lump sum amount at your chosen retirement age. Rest of the fund value is invested as an annuity for regular income to enjoy the retirement life.

Was this helpful?

What goals can I achieve with this plan?

You can achieve a happy and peaceful retired life without worrying about finances, with this plan. A new home, a foreign trip or a lovely gift for your spouse; you can achieve all your post-retirement dreams with this plan.

Was this helpful?

Does this plan cover COVID-19 claims?

Yes, this plan covers death due to COVID-19.

Was this helpful?

What is vesting age?

Vesting age is either your retirement age as per norms or an earlier date if you plan

to retire early.

Was this helpful?

What is the Maturity Benefit under this plan?

On reaching vesting age, the maturity benefit is Higher of:

(i) Fund Value at maturity

(ii) Assured Benefit, where Assured Benefit is 101% of total premiums paid till maturity

Was this helpful?

What are the risk strategy options available?

There are 2 risk strategy options you can choose from - ‘aggressive’ or ‘conservative’, depending upon your risk appetite. Basis the strategy you choose, your fund allocation towards ‘Pension Growth Fund’ and ‘Pension Secure Fund’ will vary.

Was this helpful?

What is the minimum and maximum entry age?

The minimum entry age is 18 years and the maximum entry age is 75 years.

Was this helpful?

What is the minimum and maximum maturity age?

The minimum maturity age is 45 years and the maximum maturity age is 85 years.

Was this helpful?

What is the minimum and maximum policy term?

The minimum policy term is 10 years and the maximum policy term is 67 years.

Was this helpful?

How long do I need to pay my premiums and at what frequency?

You can pay your premiums as Single Pay (one-time), Limited Pay (5 years) or Regular Pay. You can choose the payment frequency as annual, semi-annual, quarterly or monthly.

Was this helpful?

Does this plan have a Free Look Period?

You have a freelook period of 30 days from the date of the receipt of the policy document for the policy issued after 1st April, 2024 and processing TAT for same is 7 days.

Was this helpful?

Are there any Discontinuance charges?

Yes, there is a discontinuance charge. This is a charge levied on the Unit Fund/Policy Account Value where the policyholder opts for complete withdrawal of the policy. Please read the policy brochure for details on rate of discontinuance charges.

Was this helpful?

Are there any Exclusions to this plan?

In case of death due to suicide within 12 months from the risk commencement date or from the date of revival of the policy, your beneficiary shall be entitled to receive at least 80% of the Total Premiums Paid, provided the policy is in in-forc

Was this helpful?

Does this plan have a Grace Period?

Grace period of 15 days, where you pay the Premium on a monthly basis, and 30 days in all other cases, is available.

Was this helpful?

Any queries

We are always there for you !

For queries, write to [email protected]

Video Easy Pension

Videos

1- For annualized premiums of Rs. 45,000 and above, Guaranteed Loyalty Additions, as a percentage of average of last 60 months’ fund value, is added at the end of 10th policy year and every 5th policy year thereafter till maturity. This is applicable only if all due premiums are paid and the policy is inforce.

2- For Single Pay policies, Guaranteed Enhancers equal to 0.25% of last 12 months’ average Fund Value, is added at the end of every policy year from 6th policy year onwards till maturity.

^³ - Source: Nasscom Foundation concludes the 3rd edition of TechForGood Awards 2024, powered by CGI to recognize innovations driving social impact. Among our Udaan Strategy’s 4 key projects, Bolt has helped us introduce insta-decision capabilities in our customer onboarding journey. This in turn has significantly improved customer buying experience. This award recognizes this innovative use of technology to create positive impact.

** - Claim statistics are for Financial Year 2024-25 and is computed basis individual claims settled over total individual claims for the financial year. For details, refer to Public Disclosures in our Website.

The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year

Unit Linked Insurance products are different from the traditional insurance products and are subject to risk factors. The premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. Edelweiss Life Insurance Company Limited is only the name of the Life Insurance Company and Edelweiss Life – Easy Pension is only the name of A Linked, Non-Participating, Individual, Pension, Savings Product. Please know the associated risks and the applicable charges, from your Personal Financial Advisor or the Intermediary or policy document issued by the insurance company. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

For more details on risk factors and terms and conditions, please read sales brochure carefully before concluding a sale.

Edelweiss Life Insurance Company Limited (formerly known as ‘Edelweiss Tokio Life Insurance Company Limited’).

Flower & Edelweiss are trademarks of Edelweiss Financial Services Limited used by Edelweiss Life Insurance Company Limited under license.

IRDAI Reg. No.: 147 | CIN: U66010MH2009PLC197336 | UIN: 147L034V04 | ARN: WP/4298/Jul/2025

Registered & Corporate Office: 6th Floor, Tower 3, Wing ‘B’, Kohinoor City, Kirol Road, Kurla (W), Mumbai 400070.

Toll Free No.: 1800 212 1212 | www.edelweisslife.in

BEWARE OF SPURIOUS PHONE CALLS AND FICTIOUS/FRAUDULENT OFFERS IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. |