How Much Critical Illness Cover Would You Need?

Blog Title

6773 |

3/14/23 10:56 AM |

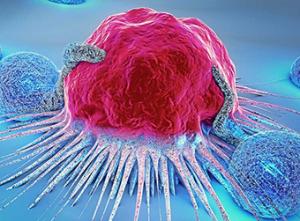

The critical illness insurance plan provides a lump sum amount to the policyholder if he/she is diagnosed with a pre-listed critical illness like cancer, chronic kidney disease, etc. The insured receives the entire sum assured on the diagnosis itself.

Here are some simple steps by which you can know the amount of critical illness cover you will need.

Calculate the Income you will need:

One simple method is to multiply your annual income by the number of years you think you will have to stay at home due to a critical illness. Multiplying by the number of years will mean that you can pay your medical expenses, bills, EMIs, your household expenses, etc. This means you and your family won’t suffer from financial distress.

You also have to think about, that for how long your family will be financially dependent on you until a different source of income comes along, like if you have to pay for your child’s higher education or marriage etc.

Calculate how much expenses you will need:

You should calculate and add all the expenses you will need during the years when you are suffering and are unable to work. This includes your annual expenses on food, transportation, medication, home care, debt repayment, groceries, etc. and subtract them from the amount of money you will get from different sources like from your spouse or relative or your life insurance plan and multiply them with the number of years you think you will not work due to the illness.

Other factors:

At the time of calculating the amount of critical illness cover that you will need, you should also keep in mind some other factors that can affect your calculation. Other members of your family who are also earning, if the expenses are likely to increase in the near future on account of a contingency, if the medical or family expenses are likely to rise due to inflation, etc.

The treatment cost of critical illnesses like cancer is as high as 20 lakhs. It is recommended that you consider all factors like rising medical costs, inflation, your family’s lifestyle, etc. and then decide on your critical illness cover.