Understanding Types of Deaths Not Covered in Term Insurance

Blog Title

75169 |

6/5/23 12:22 PM |

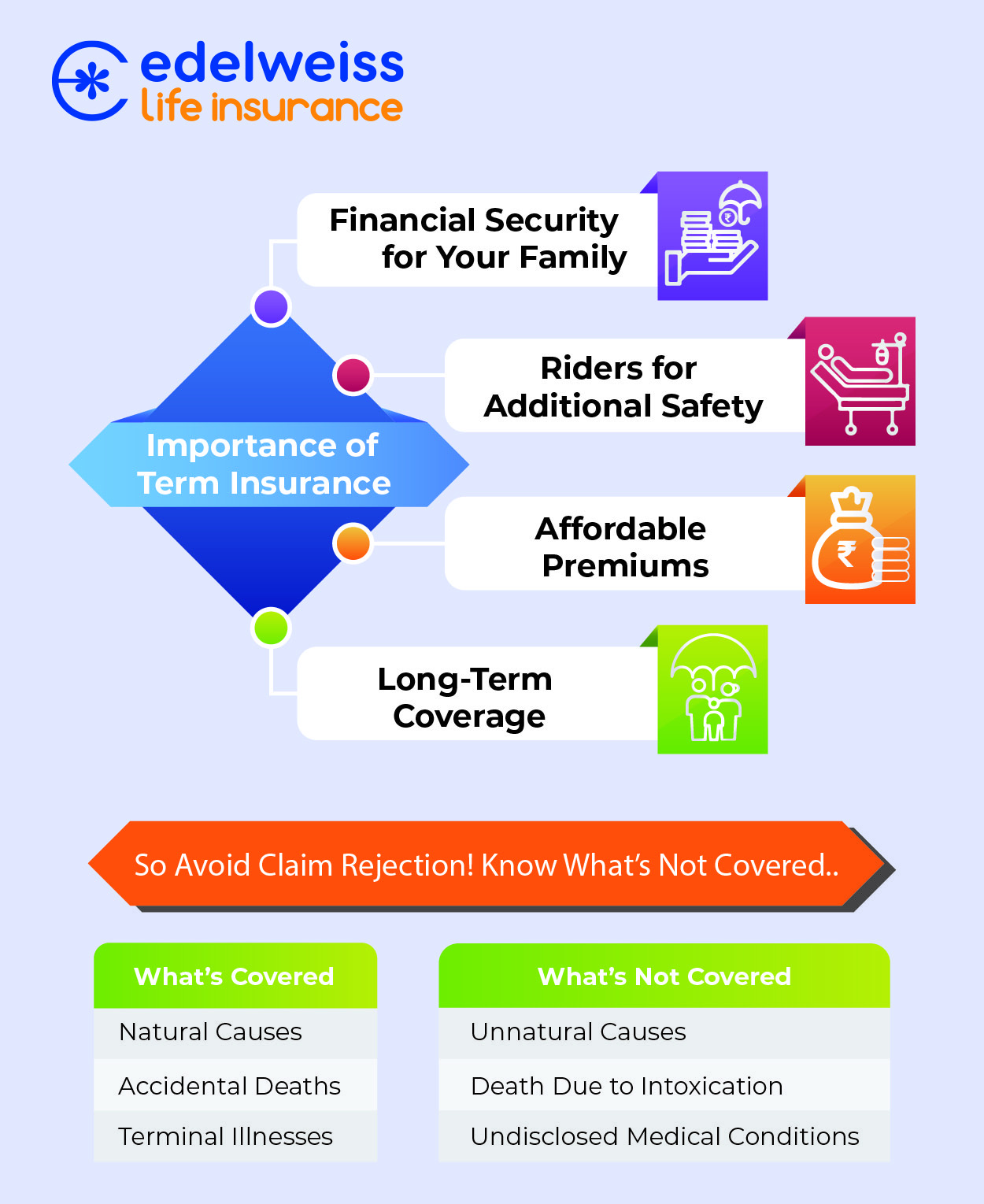

Buying a term plan is not enough. While most insurance seekers are aware that term insurance comes with a death claim benefit, there is inadequate knowledge about scenarios that are not covered under a term life plan. When you buy online term insurance, you must undertake a thorough analysis of what are the types of deaths covered in term insurance and those that are not to prevent unpleasant surprises in the future.

As most term insurance plans in India aim to provide comprehensive protection, knowing the death events that are excluded from a cover will help policyholders make an informed decision.

Types of Deaths Covered Under Term Insurance

Before delving into what is excluded from a term insurance cover, here are the types of deaths covered in term insurance:

- Natural Causes:

Term plans cover death occurring due to natural causes or a medical condition that results in the untimely demise of the insured. This includes heart attack, stroke, certain types and stages of cancer, etc. Even deaths due to natural calamities such as floods, earthquakes, etc., are covered under term insurance. - Accidental Death:

Death due to accidents is covered under the term plan. Accidental death is defined as a sudden, unforeseen, and involuntary happenstance. Individuals who travel frequently are recommended to buy an accidental death benefit rider for an added layer of protection.

Types of Deaths Not Covered Under Term Insurance

When you buy term insurance, it is to secure the financial future of your family if something unfortunate were to happen to you. Considering this, if your nominee is unable to make a death claim in your absence, their financial standing is greatly compromised.

Novice insurance seekers often make an insurance purchase simply based on the types of deaths covered in term insurance without inquiring about those that are not covered under their term plan. Whether you already have a policy or are currently searching for term insurance plans in India, it is important to check the document for the deaths that are excluded.

To minimise the risk of death claim rejection, here are the deaths that are excluded from term life insurance cover:

- Death due to Homicide:

The death claim is rejected if the policyholder has been murdered and the investigations reveal that the nominee has been involved in the crime. The death benefit is only provided if the murder charges have been dropped or if the nominee has been acquitted.

Additionally, if the demise of the insured has occurred due to involvement in any criminal activity, no death benefit is offered. However, if the policyholder has had a former criminal background but passes away due to natural causes, then the nominee is eligible for a death claim. - Death due to Intoxication:

If the policyholder encounters an accident while he/she had been driving under the influence of alcohol or drugs, then the sum assured under the term insurance is not paid to the beneficiary. Additionally, at the underwriting, the insurance seeker is asked to reveal the habits of drinking. - Non-disclosure of Smoking Habits:

Several insurance seekers avoid disclosing the habit of smoking to reduce the premium for their term insurance. However, even if you are opting for online term insurance, the insurance provider asks for medical reports, and it is practically impossible to hide the traces of smoking. Even at the time of claim settlement, the insurance provider investigates whether the policyholder had been smoking.

Therefore, to prevent any future shocks, it is imperative to reveal your smoking habits to your insurance company before you buy term insurance. It is also expected to intimate your insurance provider if you have started smoking after you purchased term insurance. Read this: Benefits of Buying Term Insurance Plan for Smokers. - Death due to Involvement in Hazardous Activities:

Insurance providers categorise insurance seekers basis their risk profile and charge a premium amount accordingly. Involvement in adventure sports comes with a certain risk associated with them. The chances of an accident are higher if you are engaged in activities such as mountain climbing, skydiving, bike or car racing, etc. Therefore, deaths under these circumstances are not covered under term insurance.

Aside from these, engagement in any hazardous activity is not covered under a term plan because these activities pose a potential threat to the life of the insured and might result in fatal accidents. This includes death due to any self-inflicted injuries. - Death due to Suicide:

The death claim for suicide comes with certain conditions based on the time when the policy was purchased. From the inception of the term life policy, if the insured member dies due to suicide within 12 months, the claim is not honoured by the insurance provider. To put it simply, death due to suicide is excluded from the cover for the initial 12 months of policy purchase.

If the policyholder dies owing to suicide during the exclusion period, then 80% of the premiums paid are returned to the nominee. However, if the insured passes away due to suicide after 12 months of the policy purchase, then the death benefit is paid to the beneficiaries. - Death due to Pre-existing Health Concerns:

Term insurance does not cover death occurring due to sexually transmitted diseases such as HIV or AIDS. Even death occurring due to terminal illnesses is not covered under a term plan. These can include diseases such as fourth-stage cancer, particular kinds of diabetes, etc. As health concerns are on the rise, it is recommended that when you buy online term insurance, you strengthen it with a critical illness rider.

The Edelweiss Life term plan offers comprehensive coverage to ensure your happily ever after. It comes with a choice of four riders to strengthen your policy with added benefits.

Conclusion

The best term insurance plan is one that considers your lifestyle to provide you with the right cover. To ensure seamless claim settlement, ensure that your underwriting process is honest. However, before you buy term insurance, it is important to check the claim settlement ratio of the insurance company as it helps you gauge its reliability. Finally, don’t buy term insurance before reading all the documents carefully.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.

FAQs

Does term insurance cover natural death?

- Yes, natural deaths are covered by term insurance.

Is accidental death covered in term insurance?

- Yes, accidental deaths are also covered by term insurance plans. Nominees will receive the full death benefit in case the policyholder passes away due to an accident. Moreover, you can increase the payout received in the death benefit by getting the Accidental Death Rider. The Accidental Death Rider adds an extra sum to the life cover amount in the insured person passes away in an accident. However, please note that any non-disclosure of rightful facts can lead to your claim amount being declined. To know more about such exclusions, please refer to your policy document. T&C apply.

What kind of deaths are covered in a term insurance plan?

- Death due to natural causes, terminal illnesses, and accidents are fully covered by life insurance policies. However, note that accidents caused due to the policyholder’s negligence or during adventure sports might not be covered by some term insurance plans. No term plan will provide coverage if death occurs due to an illness that was undisclosed during the underwriting process. To know more about such exclusions, please refer to your policy document. T&C apply.

Does term life insurance cover cancer death?

- Yes, term insurance will provide coverage for deaths caused by cancer. However, if the life insured was already suffering from cancer before buying the policy, and did not disclose their medical condition, then death claim might be rejected.

Is heart attack accidental death?

- Heart attack is generally considered a critical or terminal illness, as it is a medical condition and not an unnatural accident. Heart attacks may sometimes fall under the accidental death category, but only if the heart attack was directly caused due to an accident.