Understanding the Difference between Critical Illness and Terminal Illness Insurance

Blog Title

60190 |

10/20/23 12:06 PM |

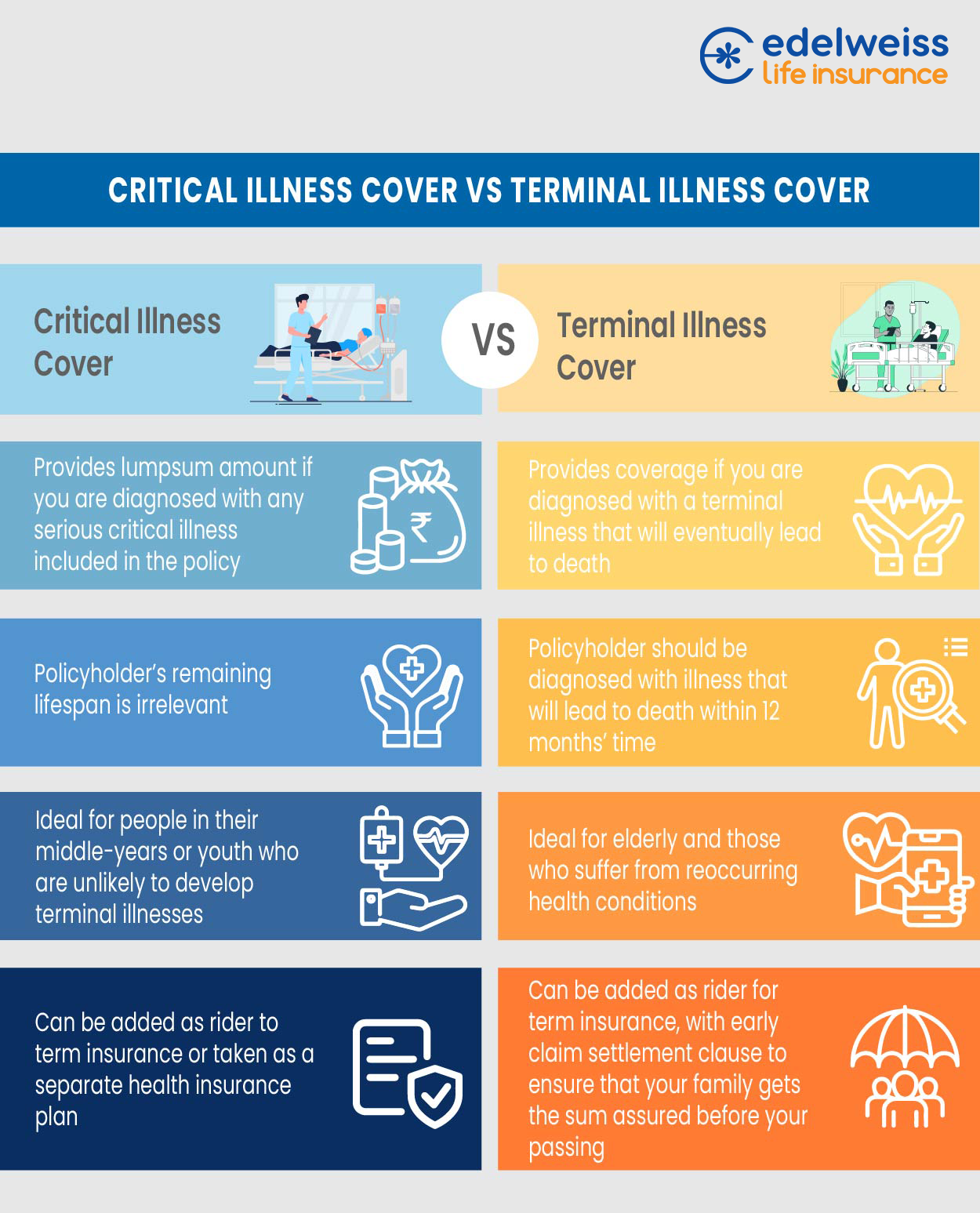

Insurers are increasingly trying to equip you with information you need to make the right financial decisions, as when it comes to insurance, one policy cannot fit all your needs. While the basic premise of life insurance is to protect the financial interests of your family post your death, there are many variant plans available that cover for different unexpected emergencies. Critical Illness Health Insurance and Terminal Illness Insurance are two such plans that protect the financial interests of your loved ones in case of healthcare emergencies, and contrary to the popular belief, these plans not the same.

What is Defined as Critical Illness?

To put it simply, a critical illness is an illness that is serious but can be cured through intensive medical treatment. Whereas a terminal illness is one in which the illness is quite grave, and no further treatment can be done to cure it. A critical illness may be deadly if not treated properly, but generally, with proper medical care and a long period of rest you will eventually recover. Moreover, an illness needs to be debilitating, meaning that you cannot work during treatment, to be considered critical.

What is Defined as Terminal Illness?

An illness is said to be terminal when medical procedure can cure it and the symptoms will eventually lead to death. Terminal illness is sometimes also called life-limiting illness. A critical illness may become a terminal illness if the patient does not get proper medical care during the initial stages of the disease.

How Does Critical Illness Health Insurance Work?

When a critical illness cover is added to an existing insurance plan, the insurance provider will pay a lumpsum to the policyholder if they are diagnosed with any of the critical illnesses specified in the policy term. This lumpsum is paid out irrespective of the policyholder’s life expectancy. The illnesses which are generally covered by a critical illness cover include cancer, heart diseases, head injuries, total or permanent disabilities, etc. The policyholder needs to show any proof of hospitalization or provide any medical certificate.

How Does a Terminal Illness Cover Work?

A terminal illness cover is concerned with paying out the insurance money to the policyholder if they are diagnosed with a serious illness that reduces their life expectancy to less than 12 months. Anyone with a terminal illness cover can rest assured that their family will be well taken care of when they pass away.

Critical Illness vs Terminal Illness Cover: Which One Should You Get?

A critical illness insurance policy cover is ideal for those who are concerned that they won't be able to meet their financial obligations or maintain a healthy standard of living if they are diagnosed with a critical illness. A critical illness cover is especially important the elderly and those who are in their middle years, as that is the life stage when a critical illness is most likely to strike. You can also use the critical illness cover to help pay offer your medical bills.

On the other hand, a terminal illness cover is suitable for people who want their finances to be in order before their demise and want to speed up the insurance payout process. Terminal illnesses can be completely unexpected and can be a massive financial burden. Having a terminal illness cover means that you and your loved ones are financially prepared for every eventuality.

Ideally, you should get a critical illness cover as well as a terminal illness cover to be on the safer side. However, if you can only get one or the other, and you are in your middle-ages or younger, then a critical illness cover might be more valid for you. Critical illnesses rarely turn terminal if they are treated correctly from the get-go, especially if you are still young.

Therefore, if you are considering buying an insurance plan or want to review your existing policy, you must understand the difference between a critical illness cover and a terminal illness cover. Both these options can provide you with valuable benefits at different stages of life, and it is up to you to choose which cover would be ideal for your protection. You can also buy the critical illness cover online as per your convenience.

FAQs

1. Is cancer a terminal or critical illness?

Initial stages of cancer are considered to critical illnesses, as you can eventually recover from cancer if you treat it immediately. However, late-stage cancer or advanced cancer is generally considered to be terminal, as at this point, the cancer has spread throughout the body and survival chances are extremely low or non-existent.

2. Is critical illness the same as terminal illness?

No, a critical illness is dangerous but recoverable, while a terminal illness is untreatable and will eventually lead to death.

3. What exactly is critical illness and terminal illness insurance?

Critical illness insurance provides a lumpsum payout if you ever get diagnosed with any illness specified in the policy. Similarly, terminal illness insurance also provides a lumpsum payout if you are diagnosed with a life-threatening health condition that will lead to your death within 12 months. Both covers are similar, but terminal illness cover gives a larger payout as the policyholder is expected to pass away.

4. Does critical illness insurance cover death?

No, critical illness insurance does not provide death benefits. Critical illness insurance just provides a payout if you get hospitalised or fall seriously ill due to a critical illness like cancer, heart disease etc. However, you can add on a critical illness rider as part of your term life insurance if you want both death benefits and critical illness coverage.

5. Is medical treatment covered by Terminal Illness Insurance?

Yes, most terminal illness insurance policies generally provide medical treatment coverage. The amount of coverage provided will vary depending on the terms and conditions of your policy. Most terminal illness covers offer 25-50% coverage for medical treatment costs.

6. Is it necessary for me to be hospitalized in order to receive the benefits of Critical Illness Insurance?

The answer to this depends on the terms provided by your insurance provider. Most critical illness covers do not necessarily require you to be hospitalised, but you will need to show proof of your illness with a medical certificate that has been attested by a doctor.

7. Is the critical illness insurance taxable?

Critical illness coverage generally falls under Section 80D which provides a tax deduction of Rs. 25,000 (Rs. 50,000 for senior citizens) on all health insurance claims. So, if your critical illness claim provides a lumpsum of over Rs. 25,000, then it might be subject to tax.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.