Benefits of Life Insurance

Blog Title

4310 |

12/13/22 2:45 PM |

Providing financial security for your loved ones is a critical aspect of financial planning. Life is uncertain and preparing for this uncertainty is the only way you can make your life stress-free and serene. Life Insurance products make it possible to do so in an affordable manner.

What is Life Insurance

In basic terms, life insurance can be defined as an agreement between you and the life insurance company where the insurer promises the payout of a sum assured to your nominees in the event of your death. In return, you pay a regular or lumpsum premium to keep the policy active for a set duration, also known as the policy term. This way, you can be at peace knowing that your loved ones will have financial security in your absence. This and many more features make life insurance a must-have in your financial portfolio, and we will go over them in this article.

What Makes Life Insurance a Necessary Part of Financial Planning?

Life insurance plans are designed to provide several advantages to the policyholder. Let’s look at a few of them. Some plans are pure life insurance plans and provide life cover for a set period at most affordable rates (like Term Insurance Plans). On the other hand, some plans, along with providing life cover can also help you build a corpus (Endowment Plans) and even create wealth through investments in market-linked financial instruments (Unit Linked Insurance Plans).

The point is that there are plenty of life insurance plans that can benefit your financial plan in more ways than one. So let us look at some benefits of life insurance that make them integral to financial planning. Considering how these life insurance benefits may help you and your loved ones is vital.

- Life Cover:

Life cover in life insurance is provided in the form of death benefit. This refers to the payout of a sum assured to your nominees in the event of your unfortunate demise. While nothing can replace the life lost, financial assistance in such a time can significantly alleviate the burden. In addition to providing continuity to your family's lifestyle, or child’s higher education; death benefit can also be utilized to cover any liabilities/loans left behind by you. - Maturity Benefits:

Maturity benefits refer to the payout you receive if you survive the policy term. The maturity benefits of life insurance allow the policy to operate as a savings vehicle. These benefits differ based on the type of life insurance plan you have. For example, a term plan with a return of premium option will return the total amount of premium paid during the tenure when the insurance matures, while an endowment policy will payout a sum assured. - Tax Benefits:

Life insurance is also a prevalent tax-saving option. Section 80(80C) of the Income Tax Act, 1961 qualifies the premiums you pay for the policy (up to ₹1.5 lacs in a year) as a tax deduction, lowering your taxable income. Furthermore, Section 10(10D) assures that any payouts received under the policy are tax-free. - Riders:

Riders are optional benefits that can be purchased and added to a standard life insurance policy. They enable you to supplement your insurance coverage. Riders cover risks that are not covered by the primary life insurance policy, resulting in complete protection against uncertainties. Riders may cover critical illness, personal accidents, family income benefits, and premium waiver benefits. They also provide tax advantages and make you eligible for life and health insurance deductions. - Loan Option:

If you have life insurance, you can take out a policy loan if you are in severe need of money. The loan amount might be taken as a portion of the policy's cash value (or sum assured), depending on the policy’ terms and conditions. - Planning for Life Goals:

Life insurance can let you fulfill your financial goals for each stage of your life. Life insurance not only provides financial assistance in the event of an unexpected death, but it also serves as a long-term investment. Depending on your life stage and risk tolerance, you can achieve your goals, whether they are for your children's education, marriage, building your ideal home, or preparing for a quiet retired life.

Benefits of Life Insurance: Our customers sum it up!

Here at Edelweiss Life Insurance, we put our customers first, and the benefits we speak of, matter only when they reach the policyholders.

Nitasha Bajaj discovered the importance of life cover after the unexpected demise of her husband left her alone with two boys to raise. The sum assured from the policy that her husband had taken out for them was paid out in full, and she received the much-needed financial assistance when it mattered the most.

Abraham K, a government employee, also used his policies for saving tax. He wanted certificates of his two life insurance policies while filing his tax returns. All he had to do was call us up, and w the certificates were mailed to him promptly by Edelweiss Life Insurance agents.

Mamta Rani, a manager by profession, is very happy with her ULIP plan due to the absence of any policy administration and allocation charges, as well as the annual bonus additions. This sentiment is furthered by another manager, Prashant W Kalnawat, who is happy with the service he has received.

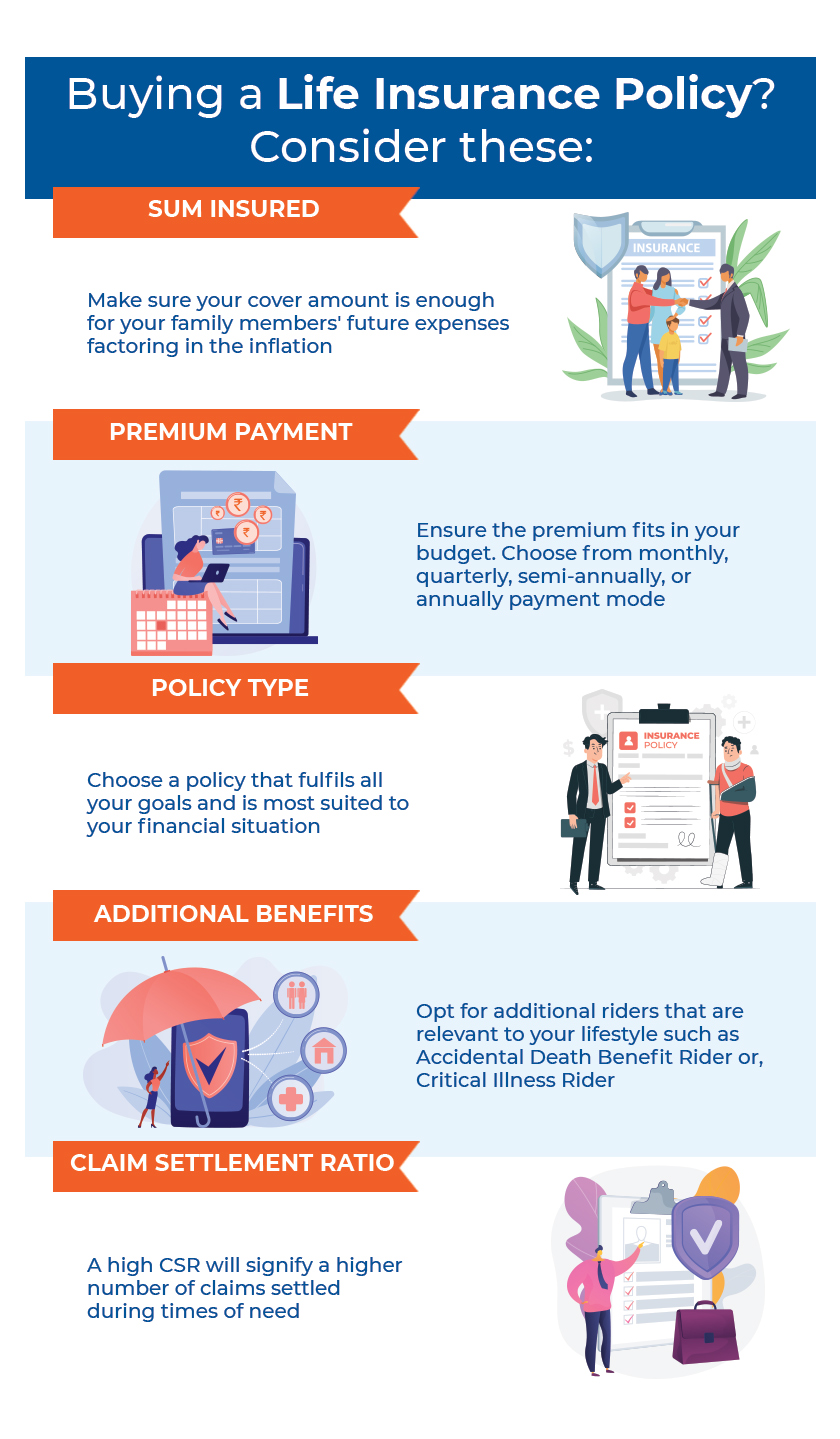

What to Look for When Purchasing Life Insurance?

Depending on your life stage, you may require different life insurance products. A person nearing retirement, for example, will need a different plan than someone who has only recently begun working. Therefore, it is critical to be well-informed on the types of insurance most suited to your financial situation.

The life insurance benefits you select can significantly impact your financial plan. Here's what you should remember if you want to maximize your life insurance benefits.

- Cover Amount

The first and most important consideration is your insurer's coverage level. Before purchasing the insurance, you must select the sum insured. Before settling on an amount, consider your family members' future demands and expenses. You should also factor in inflation while deciding the cover amount. - Premium Payment Frequency

Most insurance companies provide a variety of premium payment options. For example, you can pay the premiums monthly, quarterly, semi-annually, or annually. You should choose a frequency that you are comfortable with. - Policy Term

Choosing an appropriate term for your plan is also critical. This will also impact the premium amount. Simply said, for the same sum assured, a long-term policy will have a lower premium rate compared to a policy with a shorter term. - Relevant Riders

As previously said, riders are one of life insurance's most appealing aspects. At the time of purchase, different types of policies offer different riders. You should opt for the ones that are relevant to your lifestyle. - Terms and Conditions

Make sure you read the policy documents carefully to be aware of the terms and conditions of your policy. - Claim Settlement Ratio

An insurer's claim settlement ratio (CSR) is the indicator of the number of claims settled per 100 claims in a particular year. A high CSR will signify a higher number of claims settled and thus imply a high chance of your nominee's claim being settled.

Conclusion

Life insurance is a must-have! Any sudden catastrophe or tragedy makes us aware that life might end at any time without any warnings or signals. What if it were to happen to you? The popular saying, “failing to plan is planning to fail”, fits here very well.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.