How to Find the Best Term Insurance Plan in India 2024

Blog Title

4848 |

1/4/23 10:43 AM |

Term Insurance plans are one of the most popular life insurance products in India. A term insurance plan is a life insurance plan that you can buy to protect the future of your loved ones. The insurance company allows you to select a particular tenure for protection and pays your family the chosen sum assured if you pass away during the plan's term.

Life is quite uncertain and with the ongoing economic crisis, health conditions; the risk of untimely death has become much more relevant. This much needed monetary security is promised by a term life insurance policy, which also aids your family in absorbing the financial loss in the unfortunate event of your untimely passing.

The major challenge at hand most of the times is choosing the best term insurance to properly meet your family's future demands.

You must know all the advantages a term plan has to offer before choosing the one you want to buy. And, before we help you understand how you can find the best term insurance plan for your needs, it is important to understand a few key features of a term insurance plan.

- Because the term insurance policy only covers the risk of death, term plans have affordable premium requirements as compared to other life insurance products.

- You can enjoy tax benefits under Section 80C and 10(10D) under Income Tax Act, 1961.

- Typically, there is no cap on the amount of coverage you can have. As a result, you can choose higher coverage levels if necessary to improve your financial security.

- The plan's coverage duration can last up to 99 years of age, allowing you family or spouse, or children or loved ones, to benefit from coverage in your absence.

- Term insurance plans come with a variety of riders. You can increase the policy's coverage range and protection element with the use of these riders.

- Plans for term insurance do not have surrender values. That is, if you stopped paying the premiums, the coverage would lapse, and you would not receive any benefits.

- Under a term insurance plan, no bonuses are declared. Only the guaranteed sum assured or, life cover amount is paid in the event of death.

- Early Bird Benefit if you buy a term insurance plan early, means you pay less than someone in their 30s or 40s would for the same plan.

If you are looking to renew your term insurance policy, you can do so easily by clicking here.

Who Should Buy a Term Plan?

Every person who wants to give his or her family financial security must get a term insurance policy. So, if you are any one of these, you ought to purchase a term plan:

- If you are concerned about the financial security of your family in your absence.

- If you are someone young and the sole breadwinner of your family.

- If you are someone with financial debts and you don’t want to put a burden on your family in the event of any unprecedented circumstance.

- If you are someone who wishes to guarantee financial security for your child’s schooling or marriage or fulfil their career plans even when you are not around.

- If you want to leave a financial legacy for your family and loved ones in these uncertain times.

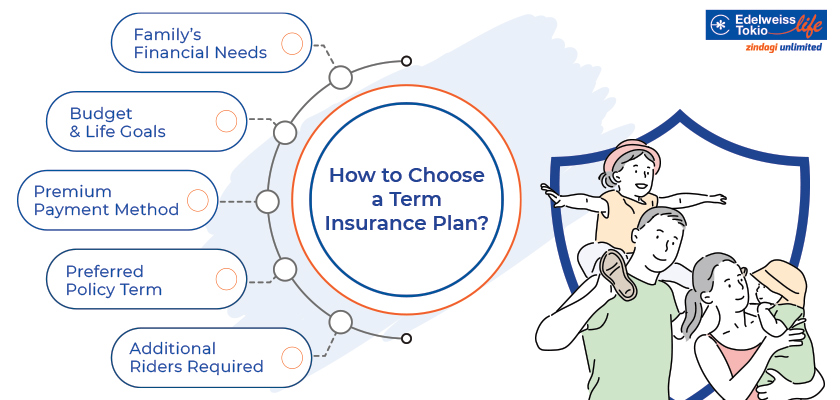

Steps for Identifying the Best Term Insurance Plan for Yourself!

In India, a wide variety of life insurance plans are offered. Term insurance is just one of them. However, due to the abundance of possibilities, picking the best term life insurance coverage might be challenging. To determine which term insurance plan is the most appropriate for you, here are a few guidelines that will help you make an informed decision.

- What are your family’s financial needs?

To start with, you must identify your needs. Find out who in your family depends on you, and what their demands are in terms of money, lifestyle, etc. After doing the calculations, determine the correct sum assured and purchase the term cover at that amount. Your age, current investments, and stage of life are all important factors in determining the term life insurance coverage required. Our online term insurance calculator helps you to know how much life cover you need.

- What is Your Budget?

Everyone wants to have a significant and high term insurance policy. However, you can have financial limitations, so that isn't always an option. For this reason, you should establish and adhere to a budget in advance. By doing this, you'll be able to easily pay the premium on time and maintain the plan in effect. For example, you can buy a term insurance plan for ₹1 Crore at just ₹ 16 per day, which is equal to the price of tea or coffee you may consume daily.

- What Premium Payment Method Suits You?

There are various choices for payment with term insurance. This includes monthly, quarterly, semi-annually, and annually.

- What are the Premium Paying options available in a Term Insurance Plan?

Premium-paying options such as regular pay or limited pay are available under term insurance plan.

- Which Policy Term suits your Family Goals & Lifestyle?

Last but not least, you must select the ideal duration for your term insurance plan. As long as your family members depend on your income, you should ideally get the coverage. For instance, if you are supporting your children, your term plan should continue until they are able to support themselves. If you have a dependent spouse, you must ensure that you have a plan takes care of their needs even in your absence. Meaning, if you are 30 years old and planning to buy a term insurance plan, it should ideally last up to 60 years of age, so that your spouse is in a position to support themselves financially. A term plan up to 70 years of age or longer if you want to leave a financial legacy for your children!

- What Riders suit you the Best?

Riders can help in making your plan more comprehensive by paying a nominal premium. Riders can be added at the inception of the policy or at policy anniversary during the policy term, subject to underwriting and terms and conditions of the riders. Include riders like the accidental death benefit, critical illness coverage, waiver of premium, etc. when acquiring a term insurance policy. These riders can be a little more expensive, but the advantages they offer make the extra expense well worthwhile.

Helping your loved ones in their hour of need is the goal of a term insurance plan. Purchase a product that meets their needs rather than one that is only cheaper. The aforementioned considerations can serve as general suggestions for selecting the best coverage. However, it is wise that you alone make the ultimate selection, so your family's needs should direct the purchase.

Buying Term Insurance is as easy as Online Shopping

Now you can buy term insurance cover simply with a few clicks, from the comfort of your couch. We can simplify the online term insurance buying process in the following four steps:

- The online premium calculator will estimate the amount of term cover you should have based on your income and age.

- Select preferred policy tenure and premium payment frequency and mode for the policy.

- Select additional benefits like Child Future Protect, Better Half Benefit, Riders and choose your nominee.

- Complete the application form and go for medical check-up.

Sit back and relax as we help you secure your future with a term insurance policy! To learn more about term insurance plans offered by Edelweiss Life Insurance, click here.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.