Term Insurance vs. Endowment Plan: Which One Suits You Best?

Blog Title

40929 |

5/29/25 7:06 AM |

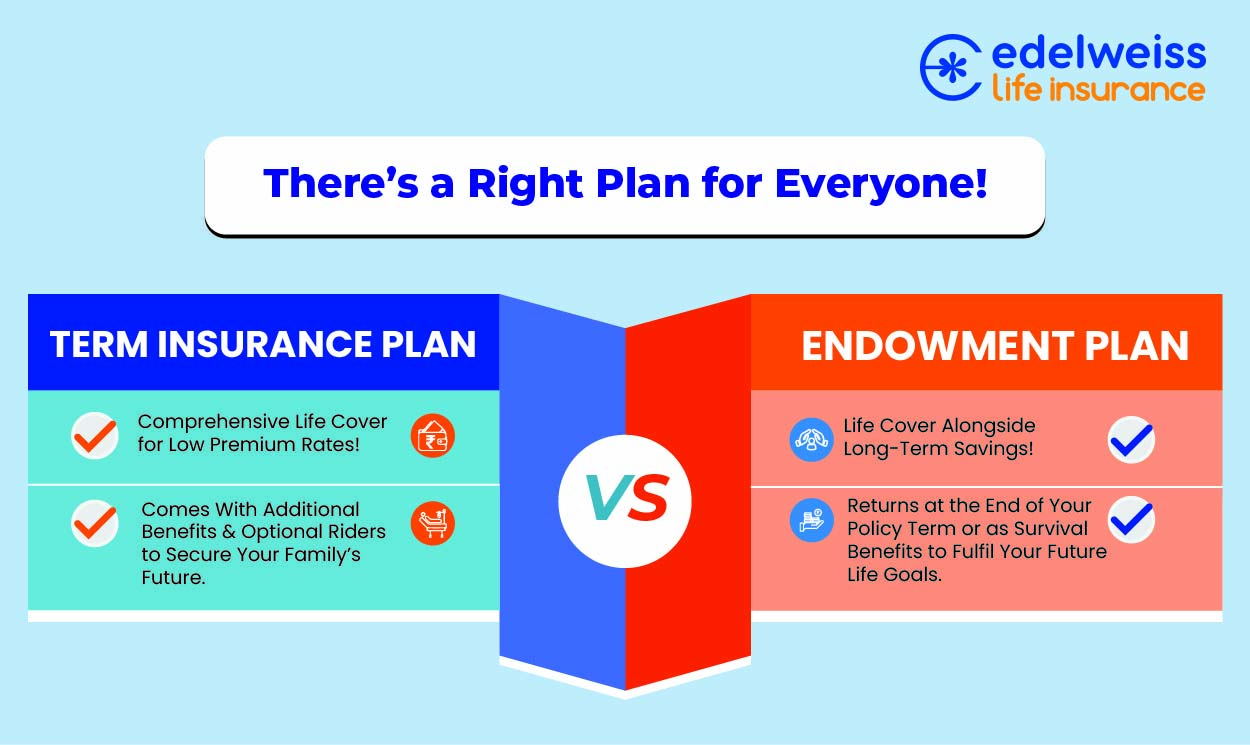

When it come to life insurance, most people are aware that both term insurance and endowment plans offer life cover as their primary benefit. However, they both cater to different needs. While term plans fulfil the need for protection, endowment plans fulfil the need for savings. You will be able to choose the right plan for yourself once you identify the differences, the features, and your needs pertaining to each category of life insurance. These factors can help you choose the best life insurance policy or make a comparative analysis of term insurance vs an endowment plan.

What is Term Insurance?

A term insurance plan offers pure life cover to one’s family, wherein the family is protected against future financial risks in the event of the insured’s untimely demise during the policy term. The nominees receive the sum assured as a death benefit that helps them cover their financial requirements in times of need. Check out the new term plan from Edelweiss Life Insurance here.

Benefits of Term Insurance

Affordable premiums for higher life cover

Optional riders for security

Flexible policy term

Tax benefits under income tax act

Best Suited For

Term insurance plans are ideal for those who are looking for pure financial security. Term plans offer significantly higher life cover amounts for lower rates of premium, which means that you can ensure your family’s financial security for a far more reasonable price. However, term plans do not offer any returns at term end. Hence, they are considered ‘pure life cover’ plans and not ‘savings’ plans.

What is Endowment Insurance?

An endowment plan offers the dual benefit of a life insurance cover as well as long-term savings. With the help of an endowment insurance plan, one can save a corpus for their future financial goals while protecting themselves and their family under a single plan.

Benefits of Endowment Insurance

Offer dual benefits of life cover and savings

You get returns in the form of survival or maturity benefits

Life cover assures your family’s financial security

Helps plan for major life goals

Tax benefits under Section 80C & Section 10(10D)

Best Suited For

Endowment plans are a great way to grow your savings while also securing your loved ones via life cover. Some endowment plans are completely guaranteed, meaning that you can calculate your future returns on day one with complete accuracy. The main benefit of these plans is that you can grow your savings to achieve major life goals such as your child’s education, marriage, buying a house etc. while also ensuring your family’s financial security.

Difference between Term Insurance and Endowment Insurance Plan

Metrics |

Term Insurance |

Endowment Insurance |

Type of Plan

|

A term insurance plan is a simple and basic form of life insurance that offers pure life cover. |

An endowment insurance plan provides a life insurance cover and the added benefit of savings. |

Cover

|

A term insurance plan provides extensive life cover to the insured’s family, and they receive a death benefit if the insured passes away during the policy term. |

An endowment plan is mainly a long-term savings plan that also provides a life cover to the insured and their family. |

Premium |

Term insurance premiums are very affordable yet offer a high sum assured. |

Compared to term plans, endowment plans have a slightly higher premium cost. |

Sum assured:

|

The sum assured of a term plan can be 15-20 times the amount of one’s annual income. Term plans can provide a sum assured as high as INR 20 crores. |

Endowment plans come with a savings component, due to which the sum assured is not that high. One can opt for a higher sum assured with a higher premium. |

Who is it for? |

Term plans are for anyone who wants to secure the future of their family against financial risks. |

Endowment plans are for those seeking life cover and long-term savings to fulfil their future financial goals. |

Rider Benefits |

Term insurance plans offer riders such as accidental death benefit, return of premium, critical illness cover, etc. |

Endowment plans offer riders like accidental death benefit, critical illness cover and waiver of premium riders, etc. |

Payout options |

In term insurance, the sum assured can be flexibly paid out as a lump sum, monthly income, or a combination of both. |

In endowment insurance, the sum assured is paid as a lump sum. |

Tax Benefits |

Term plan premiums, as well as the sum assured, are eligible for tax benefits under Section 80C and Section 10(10D), respectively, of the Income Tax Act. |

Endowment plan premiums are eligible for tax benefits under Section 80C of the old tax regime. The sum assured is tax-exempt under Section 10 (10D). |

Death Benefits |

Term plans only offer a death benefit to the aggrieved family if the insured passes away during the policy term. |

Endowment plans pay out the lumpsum death benefit to the beneficiaries if the insured passes away during the policy term. |

Maturity Benefits

|

Pure term plans do not offer maturity benefits. But the return of premium term plans offers the total of all the premiums at the end of the policy term to the insured. |

Endowment insurance plans offer maturity benefits as a lump sum, where the policyholder gets the benefits if they outlive the policy term. |

Liquidity |

Term plans do not offer liquidity, and the sum assured will only be paid out to the late policyholder’s family. |

Endowment insurance plans enable partial fund withdrawals in case the need for funds arises. |

Term Plan vs Endowment Plan: Which One is Better and which one should You Choose?

The choice between term plans and endowment plans can only depend on one’s requirements and expectations from the life insurance plan. Each of these insurance plans can only be a better option for one if they know how the policy will fulfil their needs.

Life Cover:

For someone who needs only a pure life cover that will ensure financial security to their family, a term insurance policy will be a better selection over an endowment plan. This is because they can easily protect their family’s financial future at very affordable premiums and rest assured that, in their absence, their family will still be able to lead a comfortable life.

For Sole Breadwinners:

If you’re your family’s sole breadwinner, getting a term plan should be one of your first priorities. A term plan will ensure your family’s financial stability in your absence. Moreover, term plans offer a variety of optional benefits that further enhance the coverage for your child. So, as a young parent, you can ensure your child’s future happiness with a term insurance.

For Young Professionals:

If you are a young professional who has just started earning a salary, an endowment plan can be of great help to further grow your savings. The returns from an endowment plan can help you plan for future goals like your marriage or your future children’s education fees.

Building a Long-Term Savings Corpus:

Building a long-term savings corpus is just as important as securing your family with life cover. Endowment plans can indispensable when it comes to securing your financial growth, even if it means having to pay a slightly higher premium to provide for your life cover. Plus, if you have a long-term financial goal in mind, an endowment plan can help you achieve this through disciplined savings during the policy term.

Other Types of Life Insurance

Apart from term insurance plans and endowment insurance plans, here are some of the other offerings you can choose from Edelweiss Life Insurance:

Unit-Linked Insurance Plan: ULIPs offer the combined benefit of market-linked investment, life cover and tax savings. While one part of the premium payment goes towards market-linked investment, the other part provides life insurance cover.

Savings Plans: This is a type of life insurance plans which assured returns on investments during the policy term and upon maturity. The predetermined sum assured is paid as a death benefit.

Retirement Plans: Savings plans such as guaranteed returns plans and income plans, and investment plans such as ULIPs can be a good choice when it comes to providing life insurance and creating a long-term savings fund for retirement years.

Child Insurance: It is easy to secure your child’s future with the help of a guaranteed returns plans, ULIPs and income plans as they help build a savings corpus and offer life insurance for securing the child’s future.

Features of Edelweiss Life Insurance Term Plans

Edelweiss Life Insurance Term Plans like Zindagi Protect offer a host of features to help your family at all times:

Life Cover for your family’s security

Flexibility in choosing premium payment options

Avail of discounts on a higher sum assured

Get your spouse covered with the Better Half Benefit Option

Protect your future at affordable premiums

Flexible choice of riders to enhance your term plan

Features of Edelweiss Life Insurance Endowment Plans

Edelweiss Life Insurance Endowment Plans come with the following features to protect your family and accumulate wealth:

Enhanced life cover of up to 10 times of the single premium amount

Guaranteed amount on maturity to plan future goals

Choice to avail loan on your endowment insurance plan

Make all premium payments in one go with the Single Pay option

Maximum entry age of 70 years ensures protection even later in life

Choice of riders to enhance your endowment plan

Conclusion

Making a choice between a term insurance plan and an endowment insurance plan is simple once you chalk out a financial plan that considers the needs of your family, your financial goals and the future financial security of your loved ones. The benefits offered by these insurance plans are designed such that your goals can be met in accordance with the plan you choose.

FAQs

How much life cover should I opt for in a term insurance plan?

The minimum life cover you should strive for is at least 10X your annual income (salary + other sources of income). Of course, the higher your life cover amount the safer will be your family’s financial future. So, look for plans that offer a significant life cover amount for reasonable premium rates.

Can I change the policy term after buying term insurance?

Generally, your policy term cannot be changed after purchase. However, some insurers do allow you to modify your plan details. You will have to directly contact your insurer to find out if your policy term is changeable.

Is an endowment plan a smart way to invest and save?

Yes, endowment plans are not only a good way to grow your savings but are also useful to secure your family’s financial future.

Do endowment plans offer both maturity and death benefits?

Yes, endowment plans are life insurance plans that also offer a savings element. The death benefit will be paid out in case of your untimely death during the policy term, while the maturity benefit will be paid out if you survive till the end of your policy term.

Can I add riders to enhance my endowment plan coverage?

This depends on if your endowment plan offers riders as an optional add-on. If your plan includes riders as a benefit, then you can pick and choose which riders you want to add to your base plan.

Are there tax benefits associated with both term insurance and endowment plans?

Yes, both term plans and endowment plans are subject to tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, 1961. Section 80C offers tax deductions of up to ₹1.5 lakhs on premiums paid towards life insurance. Section 10(10D) offers tax exemptions to returns from endowment plans, provided the plan meets the terms and conditions stipulated in the section. Death benefit for both term plans and endowment plans are always tax exempt under Section 10(10D).

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.