Top 9 Benefits Of Term Insurance

Blog Title

4409 |

12/19/22 11:50 AM |

A term insurance plan is a life insurance plan that you can buy to protect the future of your loved ones for a specified term. Under the term insurance policy, you select a particular insurance tenure (Policy Term) and sum promised (Sum Assured), in return of premiums. The insurance company pays your family/ nominee the chosen sum assured if you pass away during the plan's term.

The safety of our loved ones is one of the most fundamental concerns in our lives. We want them to enjoy a life free from worries. We extend this care and consideration to all aspects of their lives, especially their finances. The main aim of a term insurance plan is to help your family cope with their financial loss thanks to a lump sum payout. These policies provide a significant sum assured for a lower premium, making term insurance affordable for everyone and allowing you to better meet your family's needs.

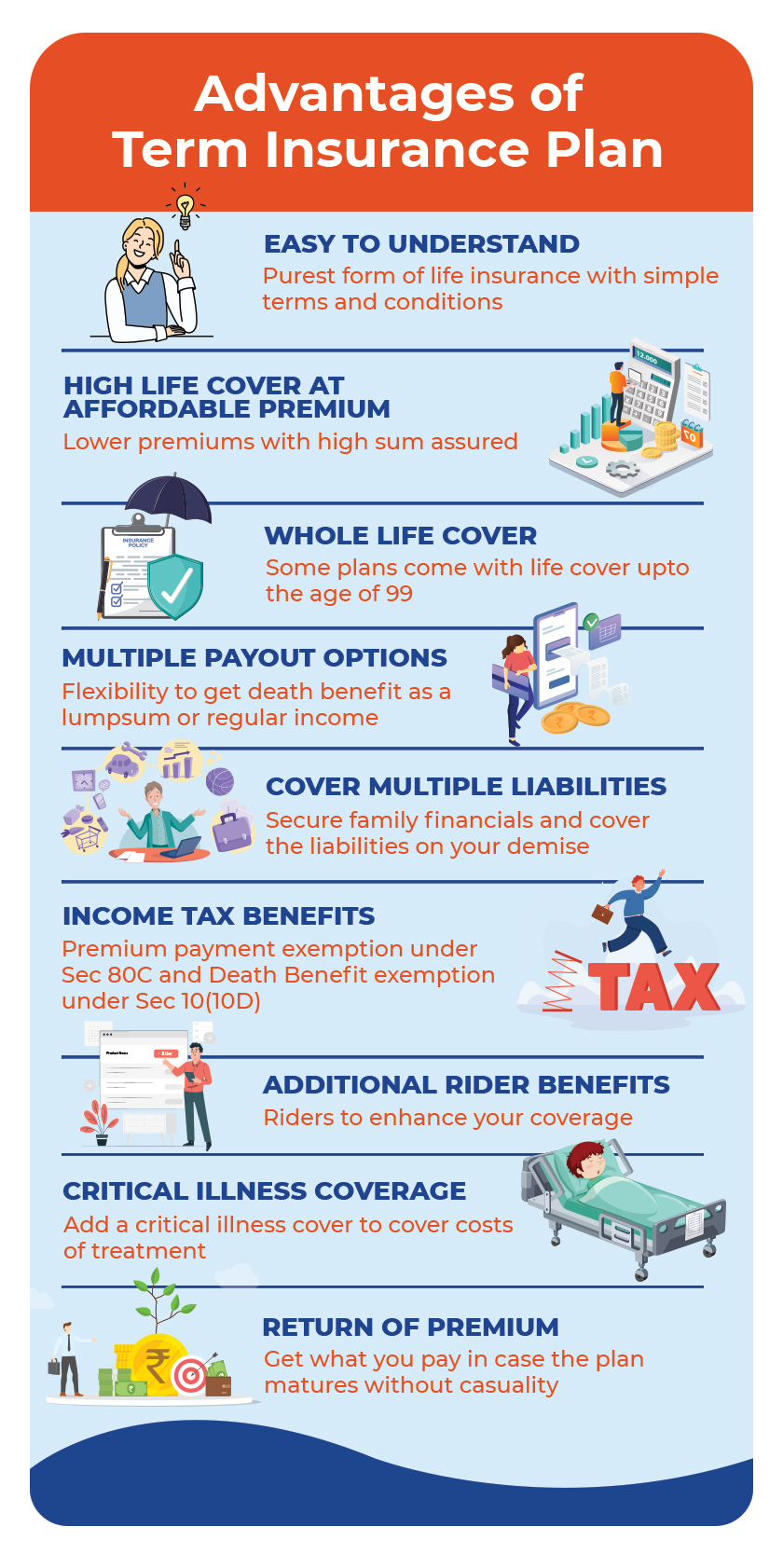

What Are the Advantages of Term Insurance Plan?

To make the most of a term plan, it is essential to understand all the benefits of term insurance so that you know you are making the right choice. Term Insurance has the following benefits:

● Easy to Understand

While acquiring any life insurance policy, it is best to thoroughly understand the specific terms mentioned inside the term insurance policy. When it comes to term insurance, it is one of the simplest policies to comprehend.

● High Life Cover at Affordable Premium

The most crucial advantage of term insurance is the low cost. Compared to other types of insurance policies, term insurance has lower premiums. Therefore, you can get a high sum assured for low premiums, especially if you decide to buy the policy early in life. Furthermore, purchasing a term plan online may be less expensive than purchasing it offline.

● Whole Life Cover

Some term plans offer whole-life protection, covering you up to the age of 99 and beyond.

● Multiple Payout Options

When purchasing the term plan, you can choose whether your nominees should get the death benefit as a lump sum payout or as regular income. The payout frequency in the case of the regular income option can be monthly, quarterly, half-yearly, or yearly. This payout option can allow the family to take care of their monthly expenses and manage them accordingly.

● Can Cover Multiple Liabilities

You may have multiple liabilities, such as a car loan, home loan, etc., and be paying EMIs for them. In the event of your unfortunate death, the liabilities may fall on your family. This is where having a term plan can be hugely beneficial. Since term plans are affordable, you can have either a high sum assured under a single plan that secures your family's finances and covers the liabilities, or you can take out multiple term plans to cover the liabilities.

● Income Tax Benefits

Term insurance plans offer tax advantages. The premium you pay to purchase a term plan is tax-free, up to a limit of Rs. 1.5 lacs per year u/s 80(80C) of the Income Tax Act of 1961. Furthermore, the term insurance death benefit is completely exempt u/s 10(10D) of the ITA, 1961.

● Additional Rider Benefits

Term plans include the option of adding riders to increase the coverage of the base term insurance plan. You can add these term insurance riders for a small additional fee.

● Critical Illness Coverage

You could be diagnosed with a severe illness at any time in your life and receiving the necessary treatment could cost you all of your savings. So, along with providing life insurance, one of the essential features of a term plan is adding critical illness coverage through riders/add-ons.

● Return of Premium Option

Term plans provide no maturity benefits. When the policy term ends, the benefits cease, and you do not get any returns. However, if you consider the return of premium option, you can receive maturity benefits under the term plan. This option requires you to pay a relatively higher premium, and the insurer will reimburse you for the complete premium paid (after applicable deductions) if you outlive the policy term.

How To Select The Correct Term Insurance Plan?

The following factors should be addressed while selecting a term insurance policy:

● Your current way of life and the financial circumstances of your dependents: Consider your current lifestyle and the financial position of your dependents, as this can help you decide the amount you require as your sum assured.

● Financial obligations and liabilities: Your financial obligations and liabilities, such as loans or other debts, would fall on the shoulders of your dependents in the event of your untimely death. To avoid this, you'll need a comprehensive cover to help.

● The insurer's CSR (Claim Settlement Ratio): The CSR (Claim Settlement Ratio) is the percentage of successful claims settled by the insurance company in a particular year compared to the total number of claims received. Every year, IRDAI publishes the CSR of insurance companies, and it is recommended that you choose an insurer with a consistently good (high) CSR.

● Additional Riders suitable to your lifestyle: You can add riders to your base plan at a nominal extra cost. They can protect against unfortunate situations, such as permanent or partial disability, critical illness, and the loss of monthly income.

CONCLUSION

Knowing the benefits and things to consider before purchasing a term plan can help you make sound investing decisions. It functions as a safety net for your family's goals if you are not present to see them through. Buy a term plan for yourself today!

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.