Protection Against Uncertainties In Life

Blog Title

2222 |

10/4/16 8:09 AM |

A comprehensive protection plan provides protection against major uncertainties in life like death and critical illnesses.

Below are few reasons why you should opt for a comprehensive protection plan:

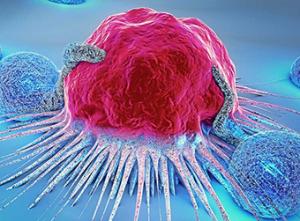

Protection against major critical illnesses

A comprehensive protection plan covers you against not just one but multiple critical illnesses. The cost involved in the treatment for critical illnesses like Cancer, Heart Disease, Kidney failure, etc. is expensive. To recover from a major critical illness you may be advised to take a long break from work due to which you may not be in a condition to provide your family with an income. But you would still need funds to take care of routine payments like utility bills, children’s fees, home loan EMI’s etc. This may take away all your savings or you may also be in debts. A comprehensive protection plan provides financial back-up in such a situation. It also covers most critical illnesses.

Taking care of your family members

If you are the breadwinner of your family and have the responsibility of tending to your aged parents and young kids, both of whom are unable to add to the income of the family, an unfortunate event can burden your spouse immensely. This event can be in the form of a critical illness or your unfortunate demise. A comprehensive term plan like Edelweiss Life Total Secure+ can keep your family prepared for any eventuality.

Edelweiss Life Total Secure+ provides you coverage against 35 critical illnesses. Generate a quote today and find out how it would help you in securing yourself and your family’s future.