Know the Importance of ‘Cash Value’ in Life Insurance?

Blog Title

23330 |

12/19/23 7:15 AM |

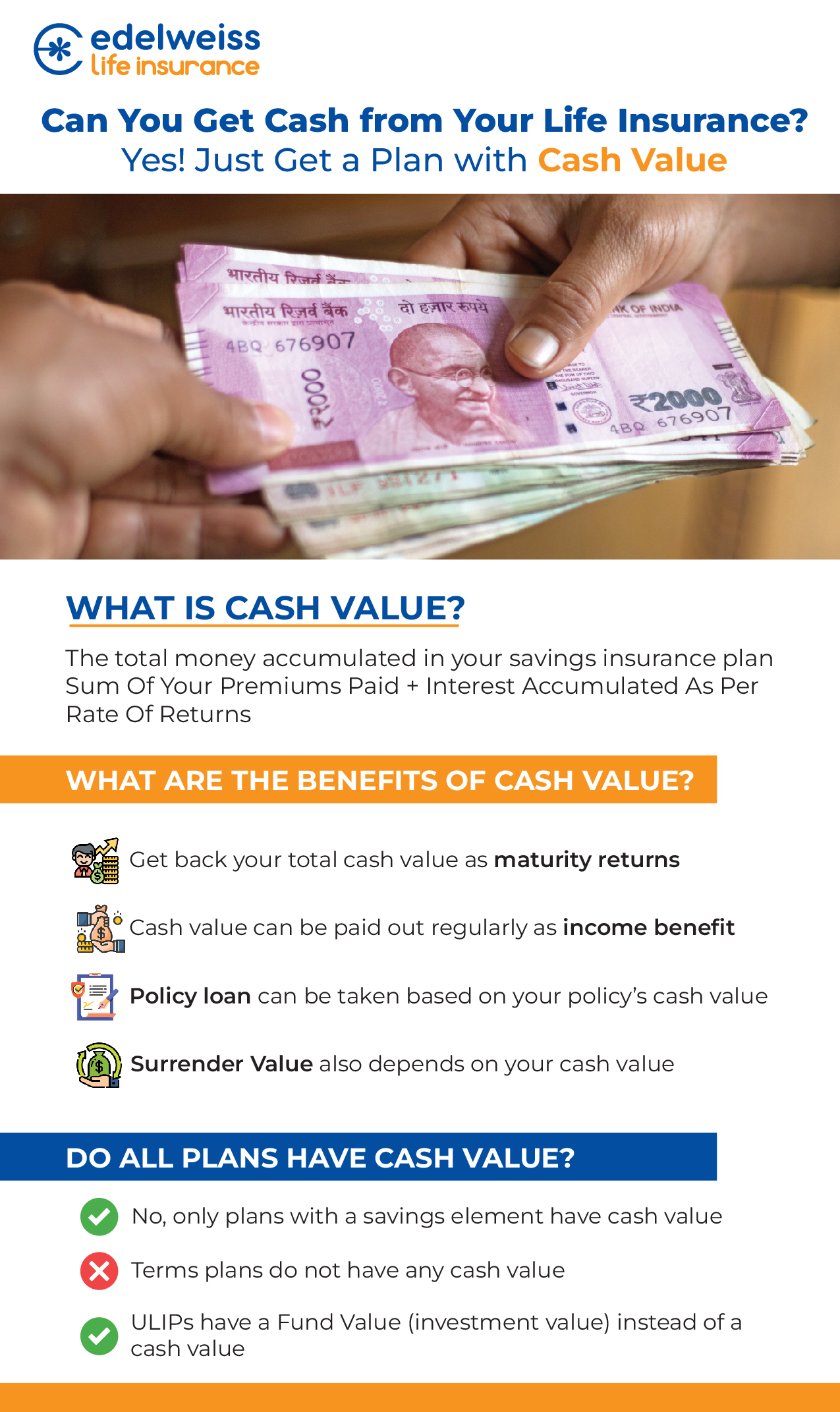

The Cash Value of your life insurance policy is the sum of money that grows over time based on the rate of returns. This value can be either withdrawn or borrowed against when you need liquid cash in hand. A life insurance plan with cash value not only protects your family when you’re gone but also offers a financial safety net during turbulent times.

Do Term Insurance Plans Not Have Cash Value?

Generally, term plans do not have cash value. Term plans are simple pure risk cover plans that offer life coverage for a premium. There is no savings or investment element in most term insurance plans. Some term plans may offer return of premium benefits, meaning that you will get back the total amount of premium paid once your term ends. However, this benefit is not derived out of the cash value, and no withdrawals or loans can be availed of through a term insurance plan.

How Does Cash Value Work?

A savings insurance plan serves two purposes, life cover and a savings corpus that grows over time. This saved money is basically the amount that you will receive as returns if you survive until the very end of your policy term. The cash value of your savings plan is generally derived from this collection of saved money. Keep in mind that not all savings plans offer cash value benefit. And usually, policies that do offer cash value have a waiting period of a few years before the money becomes accessible to you.

Types of Cash Value Provided in Life Insurance

Not all cash value benefits work the same way. Different life insurance policies have different ways by which you can access you cash value. Below are some of the most common types of cash value benefits offered by life insurance policies in India.

- Direct Withdrawal: This benefit lets you directly withdraw money from your accumulated cash value. Your cash value corpus basically acts as an account that you can withdraw from during times of financial emergency. This type of benefit is generally offered in whole life insurance policies (life-time insurance policies). Keep in mind that withdrawing money from your cash value might reduce the death benefit payout your family will receive when you pass away.

- Loan on Insurance: With this benefit, you will be able to take out a loan on your insurance policy. The amount of money you receive as a loan will be equal to your cash value. Be mindful of the fact that this a loan, not a withdrawal, meaning that you will eventually have to pay back the money you borrowed against the policy. However, the plus side of this benefit is that you can quickly get a decent sum of money during emergency situations.

- Available on Surrender of Policy: Surrendering a policy basically means that you have decided to discontinue your policy before it matures (term end). The amount of money you receive after surrendering your policy is known as the ‘surrender value’. While surrender value and cash value are not the same thing, sometimes the cash value is only paid out early if you cancel your policy. The accrued cash value will be added to the surrender value, and you will receive a lumpsum payout. However, surrendering a policy early is not recommended as it is unlikely that you will make a profit on your investment.

- Premium Payment Through Cash Value: Sometimes you cannot withdraw or take a loan on your cash value. Instead, the cash value can be used to automatically pay off your outstanding premium amount.

Do ULIPs Have Cash Value?

Unit Linked Insurance Plans or ULIPs are insurance plans that invest a part of your money into market linked funds. The amount of money you have invested in a ULIP is known as the Fund Value. Fund value works a bit differently from cash value. Fund value can only be access after a five-year lock-in period, and only 10-20% of the value can be withdrawn at any given time (depending on your policy’s T&C).

Moreover, your fund value completely depends on the performance of the market. A well performing market means a better fund value and better returns, but a poorly performing market can hurt or even reduce the overall fund value. To put it simply, cash value depends on your policy’s rate of returns, while fund value depends on the market growth rate.

What Happens to the Cash Value if You Pass Away?

Depending on the terms and conditions of your insurance policy, the cash value can either be added to your family’s death benefit or be completely absorbed by the insurance company upon your death. Usually, whole life insurance plans add your cash value to the death benefit, thus increasing its value over time. On the other hand, short term savings plans generally provide the cash value as part of your maturity benefit, meaning that you need to survive till the end of the term to receive it as returns. Of course, each insurance plan is different, which is why it is important to understand your policy’s terms & conditions.

Moreover, some policies also offer special options benefits for your family that lets them claim the cash value even after your death. For example, Edelweiss Life- Guaranteed Savings STAR provides the optional Family Income Benefit, that keeps your policy active even after your death (without any additional payments!) so that you family can receive the maturity benefits at term end.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.