Five Useful Tips on Tax Planning in India - 2025 Insights

Blog Title

23645 |

4/15/25 3:30 PM |

As a taxpayer of India, you need to file your Income Tax Returns every year. You may also know it as ITR filing. This ITR contains all the details of your annual income and the tax you need to pay to the government for the year.

People are constantly looking for efficient ways for reducing tax obligations. Tax planning can help you to save a good amount of money in the long run. With smart tax planning, you can enjoy your income to the fullest and achieve your financial goals as well. If you are looking to expand your knowledge about these tax-saving instruments, you are at the right place!

What is Tax Planning?

Tax planning refers to the strategic and lawful management of one's financial affairs with the goal of minimizing tax liability. It involves utilizing various provisions and deductions offered by the tax laws to optimize one's tax burden while staying within the legal boundaries.

In simple words, tax planning means arranging your money matters smartly to pay less tax. It's about using the rules to your advantage, so you keep more of your money legally. People and businesses do this by making smart choices about how they spend, save, and invest their money to lower their tax bills.

Effective tax planning helps individuals and businesses organize their finances in a way that reduces the amount of taxes they need to pay, thereby maximizing their after-tax income or profits. This can involve decisions related to investments, expenditures, business structure, and more, all with the aim of ensuring tax efficiency and compliance with the tax regulations in India.

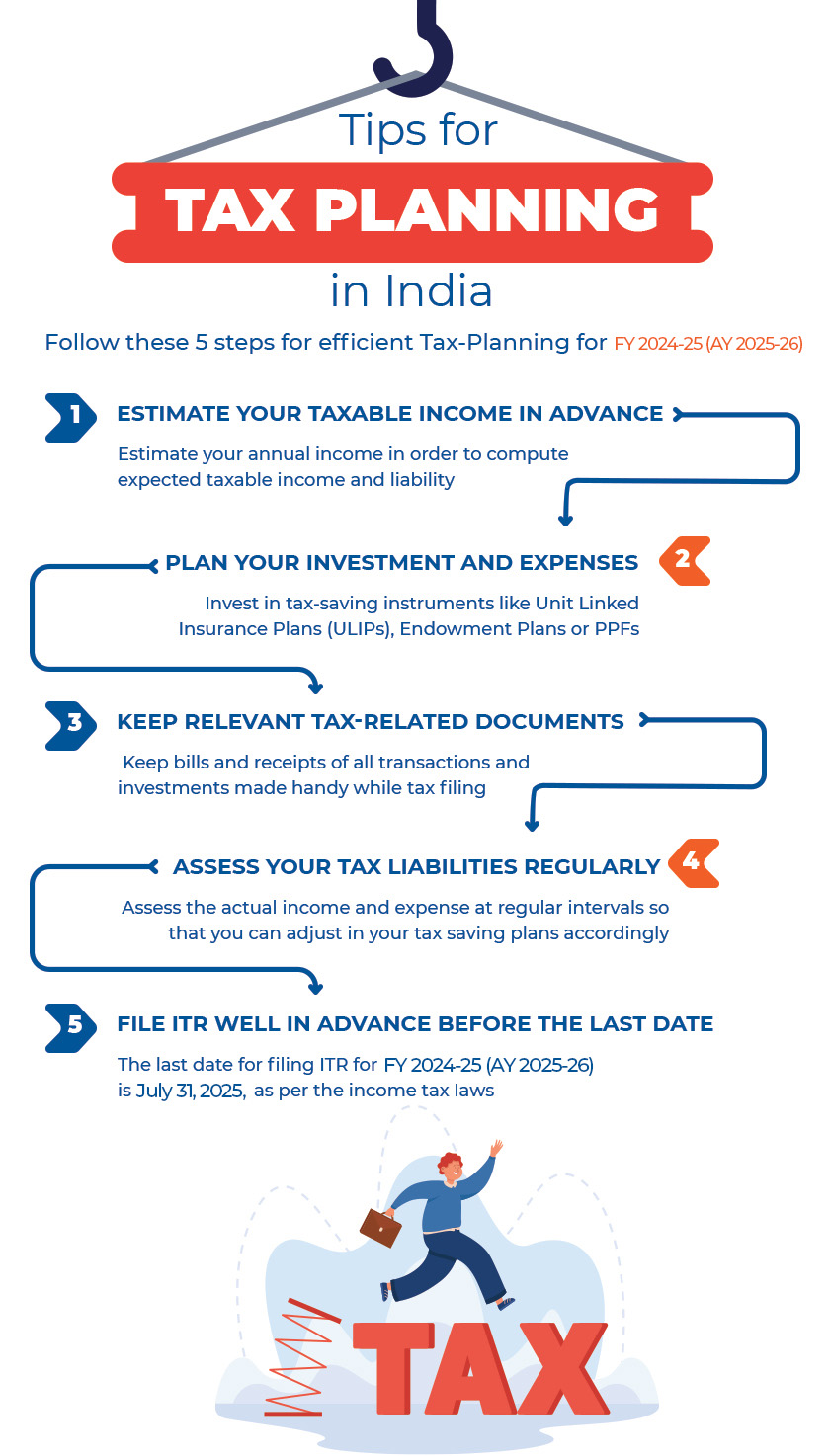

Tax planning can be done in a simple way; you just need to follow the five amazing steps for efficient tax planning.

Purpose of Tax Planning

As the cost of living increases each year, focusing on saving money has become essential. Tax planning is just one of the avenues you can use to increase your overall savings. The Government of India offers numerous tax deductions and exemptions under the Income Tax Act, 1961. By learning to utilize these tax deductions/exemptions to your benefit, you can maximize your savings by drastically reducing your tax liability. Tax planning allows you to passively grow your wealth and save more money; all while still complying with the tax laws of our country!

Types of Tax Planning

Types of tax planning are differentiated as per your personal financial goals. The four primary types of tax planning are:

Short-Term Tax Planning- Using short-term investments and insurance plans to reduce your tax liability for a single financial year.

Long-Term Tax Planning- Investing in long-term tax friendly instruments such as ULIPs, Guaranteed Savings Plans, ELSS etc. These long-term plans not only help you reduce your annual tax liability but also passively grow your wealth over a period of time.

Purposive Tax Planning- Tailoring your tax plan to achieve a specific financial goal (like purchasing a new laptop).

Permissive Tax Planning- Using every single tax deduction and exemption available to reduce your tax liability as much as you legally can.

Importance of Tax Planning

Tax planning is not just a means to save more money. When you understand the nuances of tax planning, you learn how to make smart investments that grow your wealth and take full advantage of the legal rights given to you under the Income Tax Act. When your investments account for tax deductions, you not only ensure your financial growth, but you also reduce your tax liability. This means that you will get the most out of your income while staying compliant with tax laws.

Moreover, a coherent tax plan will help you avoid audits, late penalties etc. as you will always pay your due taxes on time. Tax planning ensures your financial stability, tax compliance, and helps you increase your in-hand cash flow.

A Step-by-Step Guide: Tax Planning in India

Estimate your taxable income in advance

An estimate of how much income you will be having at the end of the financial year can help you find out your expected taxable income and amount. This will help you in accordingly find ways to reduce it using eligible tax saving instruments.

For example, if you had a taxable income of ₹5 lakh last year and you estimate a growth in net income by 20%, then your taxable income may also increase in that proportion. So, you must make a tax saving plan early to avoid the last-minute rush.

Plan your investment and expenses

Once you have an idea about how much tax liability you may incur at the end of the year, then you can accordingly plan your investment and expenses to save tax. For example, if you are expecting your taxable income to be ₹6 lakhs at the end of the year then you can start investing money every month in tax-saving instruments like Unit Linked Insurance Plans (ULIPs), endowment plans or PPFs.

Early planning will give you more time to research and select efficient tax-saving instruments, which can give you more liquidity, higher return at low risk and help you to accomplish your financial goal in a better way. Some of the popular tax-saving instruments include:

Premium Paid for Life Insurance policy

National Savings Certificate

Public Provident Fund

National Pension Scheme

Equity Linked Savings Scheme

Principal Amount for Home Loan

Fixed deposit for five years

Sukanya Samariddhi Yojana Account

Children’s tuition fees

Keep relevant tax-related documents safely in one place

During the financial year, you may spend money on things for which you can claim deductions and save tax. So, you must keep the bills and receipts of all such transactions handy. It would be wise to maintain a diary for such transactions or keep them handy in your mobile apps so that you can use it when filing tax. Medical bills, travelling bills etc are important documents which may be required as a proof while claiming deductions under the eligible heads.

Assess your tax liabilities at regular intervals

Once you have an estimated figure of the tax amount for the financial year, then you should continuously assess the actual income and expense at regular intervals so that you can adjust in your tax saving plans accordingly. For example, if you have expected a net income of ₹50,000 per month, but your income increased to ₹80,000 then you should raise the investment accordingly or take an appropriate step.

If you do not keep a regular watch on your expected tax liability, then at the end of the year

you will find it difficult to invest a huge amount all of a sudden to save tax.

File ITR well in advance before the last date

You must file the tax well before the last date to avoid mistakes as they may result in scrutiny or a notice from the Income Tax department. If you file tax in right time, then you also have a better chance to get the TDS refund in a short time.

Conclusion

Reducing your tax burden is your legal right! With the right tax plan, you can reduce your taxes while staying compliant with the tax laws. While paying taxes is good for our country, one should not pay any more than they are legally due. So, take advantage of the tax deductions and exemptions provided by the Income Tax Act, and maximize your savings for future financial goals! Life insurance plans are a great tax saving instrument as they benefit from deductions under Section 80C and exemptions under Section 10(10D). Moreover, savings plans like Edelweiss Life- Flexi-Savings Plan also provide you with a passive income source that is tax deductible.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.